Ashneer Grover, co-founder of fintech unicorn BharatPe and former Shark Tank India judge, on Wednesday condemned the Reserve Bank of India (RBI) after the central bank imposed additional restrictions on digital payments firm Paytm’s key vertical Paytm Payments Bank Ltd (PPBL).

The central bank on Wednesday barred PPBL from taking further deposits or undertaking credit transactions or top-ups in any customer accounts, wallets, prepaid instruments, FASTags or National Common Mobility Cards, after February 29.

Ashneer Grover said: “I don’t understand RBI. Clearly RBI doesn’t want fintechs in business – of late all regulations/moves are against fintechs. Such moves will kill the sector altogether. The @FinMinIndia @nsitharaman @PMOIndia need to step in.”

He further claimed that startups have been the biggest creators of market cap and employment in the last decade.

The BharatPe co-founder claimed: “Startups have been biggest creators of market cap and employment in the last decade. Today IIM and IIT are struggling to place people– we as a country cannot afford such overreach! Tom-Tom-Ing @UPI_NPCI to the world and punishing pioneers in the space is pure ‘Doglapan’!”

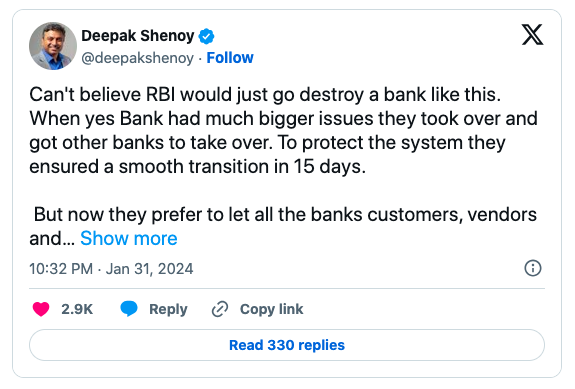

Grover, however, was not the only one to condemn the central bank over its action against Paytm Payments Bank. Deepak Shenoy, Capitalmind founder and CEO, was also shocked at the RBI’s move.

Shenoy cited RBI’s actions during the Yes Bank crisis and said: “Can’t believe RBI would just go destroy a bank like this. When Yes Bank had much bigger issues, they took over and got other banks to take over. To protect the system, they ensured a smooth transition in 15 days.”

He further called the central bank’s action as “uncharacteristically over the top”.

“But now they prefer to let all the banks customers, vendors and partners suffer and create a confidence issue unnecessarily, and force the business down. Better ways to handle this, this is uncharacteristically over the top by RBI,” Shenoy said.

He also clarified that he is not against RBI taking action but the kind of action it has taken. “Secondly, I’m not saying that RBI does not deserve to take action. I’m questioning the kind of action it’s taking– they could still censure the current management, but take over the bank and effect a merger, reducing customer/merchant angst and not hitting system confidence,” Shenoy noted.

Meanwhile, RBI attributed its action against Paytm Payments Bank Limited to non-compliance and continued supervisory concerns in the bank. The central bank, however, said that interest, cash backs or refunds can be credited anytime.

It also asked the company to settle all pipeline transactions and nodal accounts by March 15, 2024. “No further transactions shall be permitted thereafter,” the central bank said.

PPBL, however, said that RBI’s restrictions wouldn’t impact user deposits in savings accounts, wallets, FASTags and NCMC account.

It also noted that users can continue using the existing balances. Paytm’s offline merchant services Paytm QR, Paytm Soundbox, and Paytm Card Machine would continue as usual, the company said.

Source : Businesstoday.in