SUMMARY

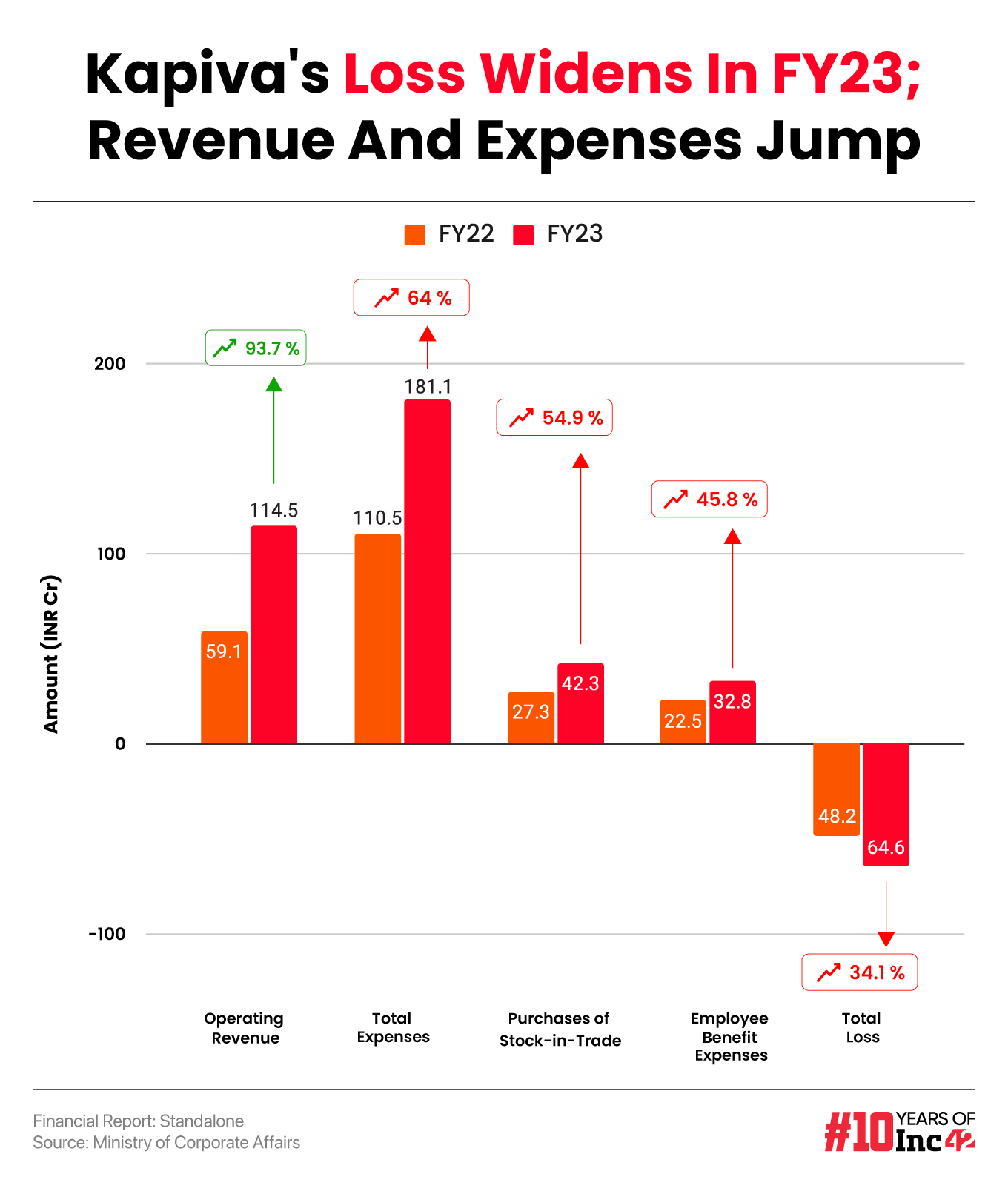

Kapiva’s bottom line was hurt despite almost a 94% jump in operating revenue to INR 114.5 Cr in the year under review from INR 59.1 Cr in FY22

Kapiva’s total expenses jumped 64% to INR 181.1 Cr in the reported fiscal from INR 110.5 Cr in FY22

Purchases of stock-in-trade contributed a majority of 52.4% to its total spending, growing 55% YoY to INR 42.3 Cr

Ayurvedic D2C nutrition brand Kapiva‘s loss widened 34% to INR 64.6 Cr in FY23 from INR 48.2 Cr in the previous fiscal year as the startup’s expenses shot up in line with its growing business.

Its bottom line was hurt despite almost a 94% jump in operating revenue to INR 114.5 Cr in the year under review from INR 59.1 Cr in FY22.

Founded in 2016, Kapiva’s ayurvedic nutrition products include ayurvedic juices and other consumables, gummies, capsules, hair oil and shampoos. It has more than 100 SKUs. The startup also enables consultation with ayurvedic doctors.

The company’s total revenue, including interest income, stood at INR 116.5 Cr in FY23 as against INR 62.4 Cr in the previous year.

Zooming Into Expenses

Kapiva’s total expenses jumped 64% to INR 181.1 Cr in the reported fiscal from INR 110.5 Cr in FY22 with purchases of stock-in-trade contributing a majority of 52.4% to the total spending.

Purchases Of Stock-in-Trade: The D2C band’s spending in this bucket increased almost 55% to INR 42.3 Cr in FY23 from INR 27.3 Cr in the previous fiscal.

Employee Cost: Kapiva’s employee benefit expenses witnessed almost a 46% rise to INR 32.8 Cr in FY23 from INR 22.5 Cr in the previous year.

In that, the startup spent INR 25.7 Cr towards salaries and wages, registering a year-on-year (YoY) increase of over 23%.

On the other hand, Kapiva’s spending towards ESOPs also increased to INR 5.7 Cr in FY23 from INR 73.5 Lakh spent towards the same a year ago.

Sales And Marketing Expenses: The D2C brand spent INR 64.3 Cr in marketing during FY23. However, the company’s FY22 spending in this bucket was not available in its FY23 financial filing.

Kapiva said that the increase in its loss in the reported fiscal was due to additional investment in team and marketing costs, due to growing business.

Freight Cost: The company spent INR 17.3 Cr in this bucket in the year under revenue, up from INR 12.3 Cr in FY22.

Backed by Vertex Ventures, Fireside Ventures, and 3one4 Capital, Kapiva has raised $15.77 Mn across multiple rounds so far. In its FY23 financial filing, the D2C brand said that it expects good business and returns in future.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)