SUMMARY

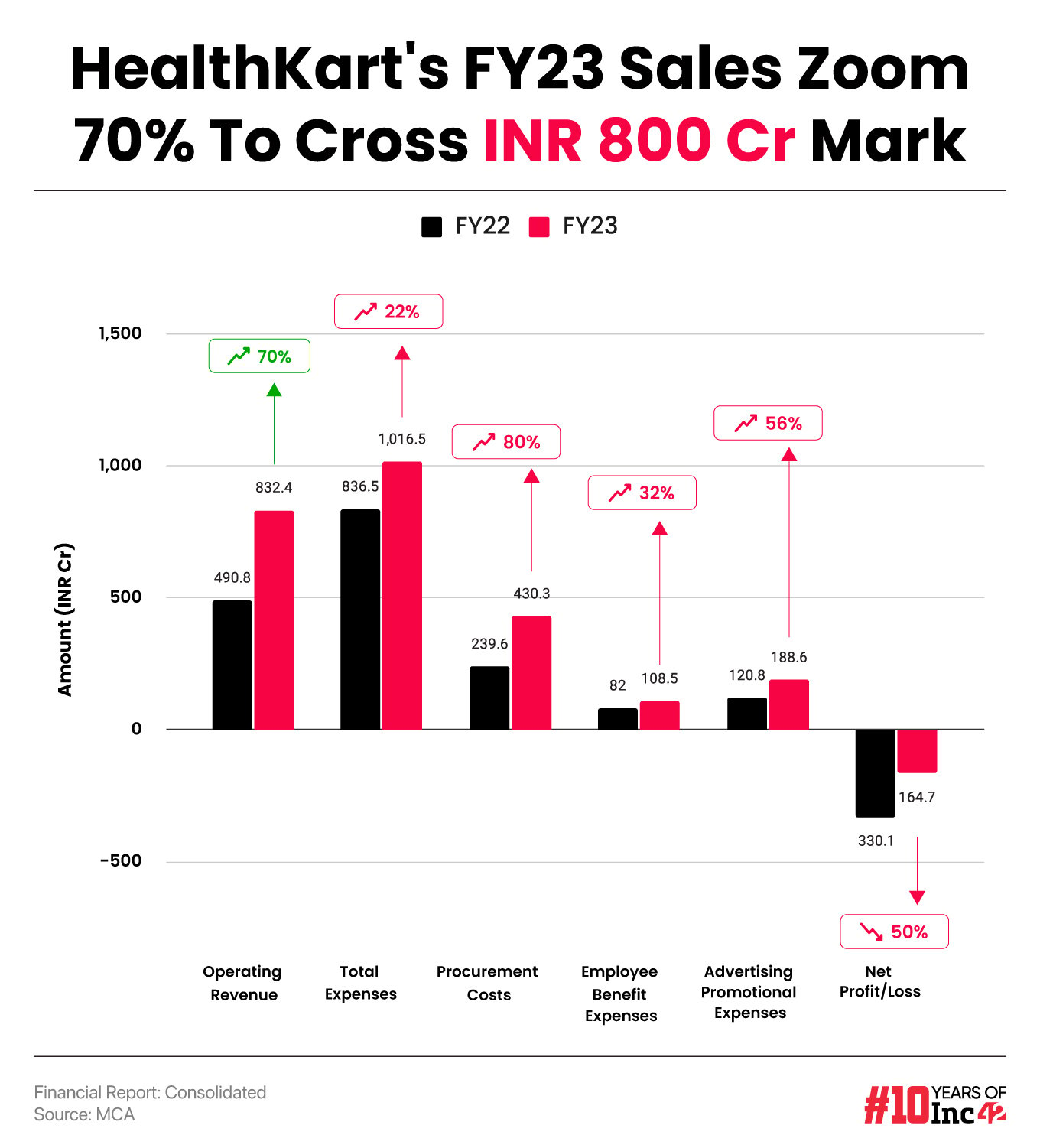

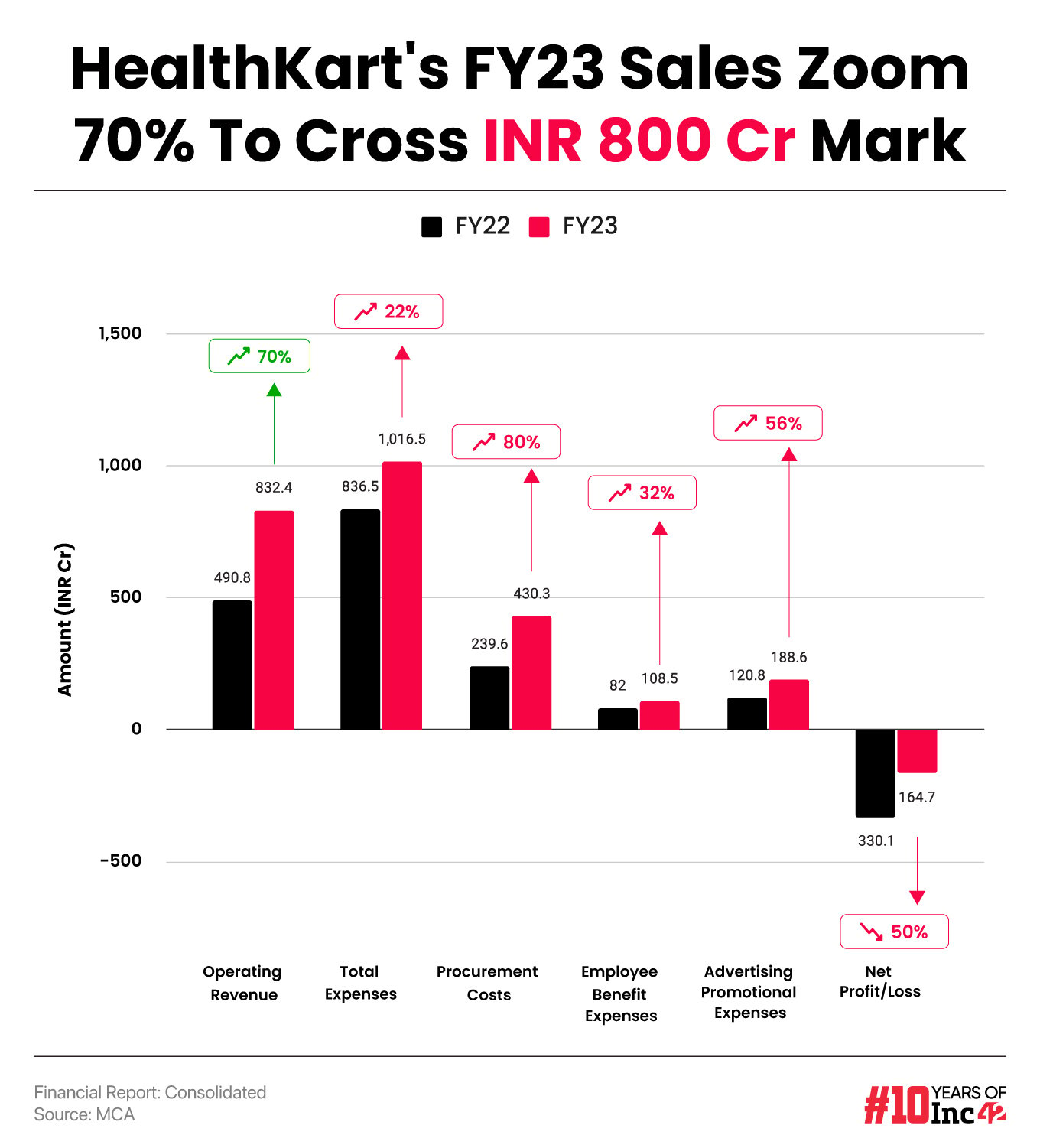

HealthKart’s sales rose 70% to INR 832.4 Cr in FY23 from INR 490.8 Cr in the previous fiscal year

Besides the rise in sales, HealthKart also managed to halve its net loss to INR 164.7 Cr from INR 330.1 Cr in FY22

The startup is said to be in talks to raise around $100 Mn-$150 Mn from ChrysCapital in a secondary transaction

Health-related online marketplace healthkart

The startup primarily earns revenue by selling healthcare products via its own website, ecommerce marketplaces, and offline stores.

Including other income, total revenue rose 68.2% to INR 851.8 Cr during the year under review from INR 506.4 Cr in the previous fiscal year.

Founded in 2015 by Sameer Maheshwari, HealthKart operates an omnichannel consumer nutrition platform. The startup claims to operate India’s largest online nutrition marketplace and is home to several digital-first brands. It also owns private label brands MuscleBlaze and HK Vitals.

Besides the rise in sales, HealthKart also managed to halve its net loss to INR 164.7 Cr in FY23 from INR 330.1 Cr in the previous fiscal year.

Where Did HealthKart Spend?

The startup reported a total expenditure of INR 1,016.5 Cr in FY23, an increase of 22% from INR 836.5 Cr in the previous fiscal year.

- Procurement Cost: This was the biggest expense for HealthKart, rising 80% to INR 430.3 Cr from INR 239.6 Cr in FY22.

- Employee Benefit Expenditure: Employee costs grew 32% to INR 108.5 Cr in FY23 from INR 82 Cr in the previous year, indicating an increase in employee headcount. Employee benefit expenses primarily comprise employee salaries, PF contribution, among others.

- Advertising Expenses: The startup spent INR 188.6 Cr on advertising and marketing expenses during the year under review, an increase of 56% from INR 120.8 Cr in the previous fiscal year.

Earnings before interest, tax, depreciation and amortisation (EBITDA) stood at – INR 138.3 Cr as against – INR 309 Cr in FY22. EBITDA margin improved to -16.6% during the year under review from -62.9% in the previous year.

HealthKart last raised $135 Mn in a funding round led by Temasek. The round also saw participation from A91 Partners and Kae Capital and valued the startup at around INR 3,000 Cr (about $370 Mn).

The startup has raised a total funding of around $200 Mn till date and counts the likes of Sofina Ventures, Peak XV Partners, and Intel Capital among its investors.

As per a report by The Economics Times, the startup is currently in talks to raise around $100 Mn-$150 Mn from ChrysCapital in a secondary transaction. The deal is expected to give exit to the startup’s early investors.

HealthKart competes against the likes of PharmEasy, NetMeds, and Tata 1mg.