Ten new-age tech startups have gone public in 2024 so far, and the likes of Swiggy, Smartworks, Ecom Express are awaiting SEBI nod to open their IPOs this year

TAC Infosec’s shares are trading over 7X higher compared to its IPO issue price. Despite a bumper listing, the stock has given a whopping 165% return compared to its listing price

Startups opting for modest IPO valuations and attaining net profitability or showing a clear path to profitability before their IPOs have resulted in the rally on the bourses this year

On the back of India’s strong macro environment, the domestic IPO market has witnessed a sharp revival this year. This has also resulted in an upsurge in public listings by new-age tech startups.

EY Global IPO Trends Q2 2024 noted that India was at the forefront of global IPO activities in the first half of 2024, accounting for more than 27% of worldwide IPOs. While there was a decline in IPO activities in global regions, including Mainland China, there were 38 mainboard IPOs in India in H1 2024 compared to 11 during the same period in 2023.

The H1 2024 number excludes SME IPOs, which stood at more than 100.

The current wave of IPO activity suggests that listings in 2024 will likely surpass the 2023 number, painting an optimistic picture for India’s primary market, the EY report said.

Bumper Gains For Startup IPO Investors

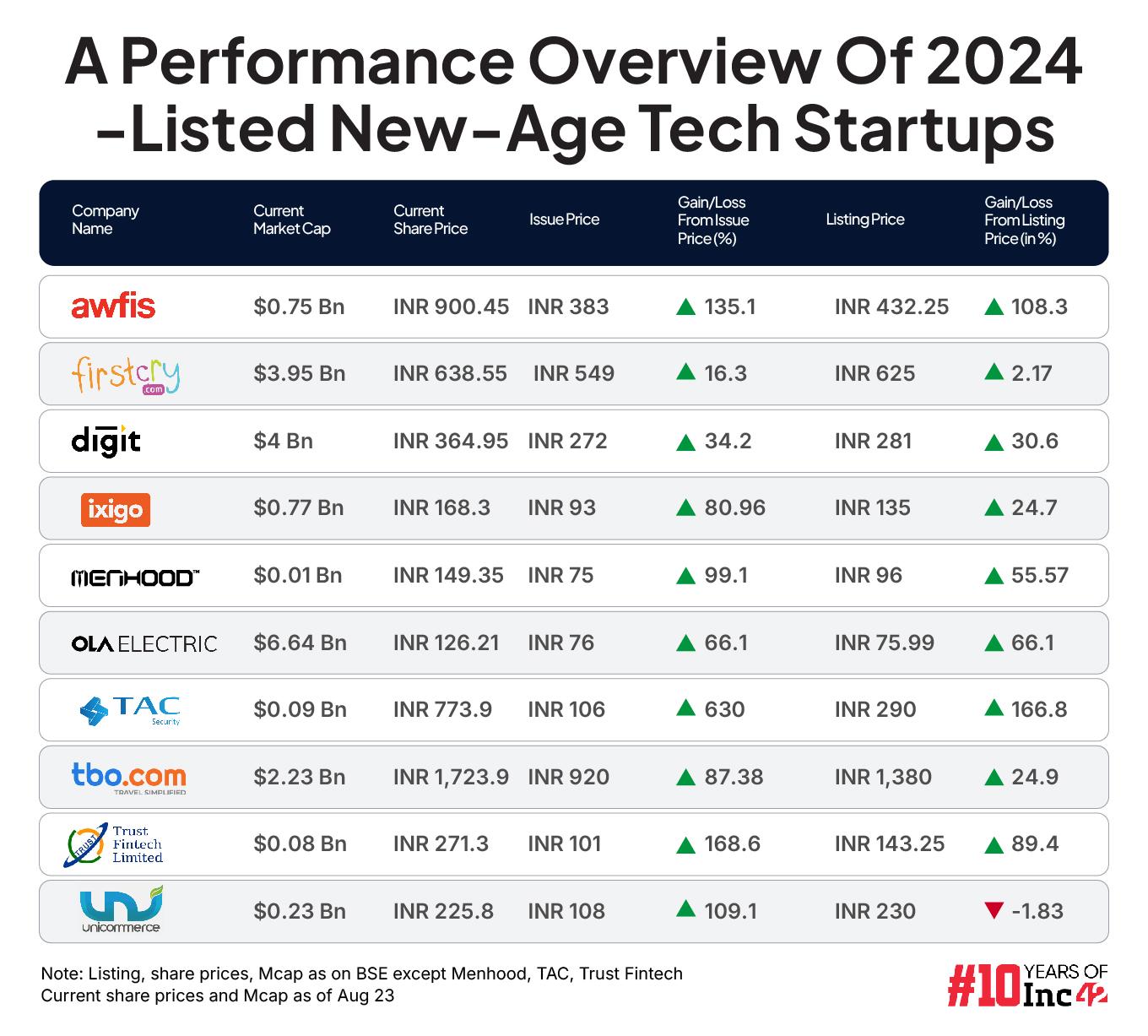

The uptrend in the broader Indian equities market and positive investor sentiment has resulted in big gains for investors in startup IPOs. Of the 10 new-age tech startups that got listed on the bourses in 2024 so far (four of them in H1), nine made their public market debut at a premium over their respective issue prices.

For instance, shares of B2B travel portal TBO Tek, which was the first mainboard new-age tech company IPO of this year, made their debut at a whopping 50% premium to the issue price on the BSE. On the NSE, the listing was at a 55% premium.

Online travel aggregator ixigo made its debut in June at a 45% premium on the BSE, while coworking startup Awfis listed at a 12.8% premium on the exchange.

In August, shares of kids-focussed omnichannel startup FirstCry and enterprise tech startup Unicommerce listed at 34.4% and 113% premiums to their issues prices on the BSE, respectively. On the NSE, they attracted a higher premium.

Meanwhile, the much-hyped IPO of Ola Electric witnessed a rather muted response on the listing day and made a flat debut on the stock exchanges. While the stock gained after listing and almost doubled from the issue price, it seems to have lost steam now.

Similarly, insurtech startup Go Digit made its debut at a mere 3% premium on the BSE. In both instances, one element was common—valuation concerns.

Before we delve into analysing the reasons behind the upbeat performance of new-age tech startups on the stock exchanges, let’s take a quick look at the key numbers.

These 10 startups have cumulatively mopped up over INR 16,200 Cr in total from the public market.

TAC Infosec, Awfis Give Bumper Returns

Besides the high premiums which the new-age tech stocks attracted this year over their issue price due to huge demand, what stands out is that most of the stocks have continued to gain post their listings.

While all 10 stocks are trading way above their issue prices, most are trading 20-160% higher than their listing prices. TAC Infosec, which got listed on the NSE Emerge, has been the biggest wealth creator this year. Its shares are trading over 7X higher compared to its IPO issue price. Despite a bumper listing, the stock has given a whopping 165% return compared to its listing price.

It is followed by Awfis. The coworking startup’s shares got listed at a premium of over 135% to its issue price and have more than doubled from the listing price.

Except for FirstCry, which has gained 2.2% since listing on August 13, and Unicommerce, which has fallen 1.8% since listing on the same day, others have had a bull run.

However, it is pertinent to ask at this point if this rally is sustainable. After all, a similar boom was seen in 2021 when new-age tech startups like Zomato, PB Fintech, Nykaa, among others, went public. Their public offerings also received massive response from the investors and their shares gained significantly after listing. However, there was a bloodbath in these stocks in 2022.

It is this past experience which has led to a lot of debates about valuations and performance of new-age tech startups that have gone public this year, especially Ola Electric.

However, there are some major differences between the 2024 startup IPOs and those of 2021. Learning from the past mistakes, most of the new-age tech startups opted for modest IPO valuations this year to woo investors. Many also lowered their IPO size.

lockquote>

Besides, given the inhibition of the public market to loss-making entities, most of these startups went public after achieving net profitability or clearly demonstrating their path towards profitability.

Decoding The Rally In New-Age Tech Stocks & The Path Ahead

Speaking on IPO trends this year, Navin Honagudi, managing partner at Elev8 Venture Partners, told Inc42 that startups opting for lower valuations for their IPOs suggest that they are taking a cautious approach. He added that investors are also much more discerning now.

“In 2023, we saw valuations of tech IPOs averaging around $2 Bn, much lower than the $5-10 Bn we saw in previous years. This shift is really about investors wanting solid, sustainable businesses over flashy valuations,” he said.

“Investors can learn several important lessons from this trend toward modest valuations. First and foremost, it is critical to strike a balance between risk and reward by focusing on a company’s fundamentals rather than getting caught up in the excitement around high valuations. The market is increasingly rewarding organisations with a clear and feasible growth strategy, rather than those that make lofty promises but lack the required foundation,” Honagudi added.

lockquote>

Commenting on Ola Electric, he said that the EV major’s flat debut on the bourses, followed by a gradual rise in its share price after listing, shows that market is becoming more patient. Rather than rushing in immediately, investors are taking their time to assess the company’s potential in the public market.

“The capacity of Ola Electric to deliver on its promises will be critical in determining if this surge is sustained. Unlike the roller-coaster experiences of Zomato and Paytm, where post-IPO corrections were severe, Ola Electric appears to be benefiting from a more moderate initial valuation, allowing for a more gradual increase in stock price,” Honagudi added.

Meanwhile, many brokerages are also bullish on Ola Electric’s long-term growth. HSBC Global Research recently initiated coverage on the stock with a ‘buy’ rating, saying that the EV startup is worth investing in despite the brokerage having a conservative view on EV penetration in India.

However, Rupak De, senior technical analyst at LKP Securities, said that shares of Ola Electric saw heavy profit booking at around INR 150 level and are likely to move down.

lockquote>

The stock’s current support is at INR 115 and the resistance is at INR 132, he said, adding that the sentiment would remain negative till the time the stock is below its resistance level.

Meanwhile, De expects ixigo to continue its uptrend and move towards the INR 190 mark from around INR 165 currently. He said that both Go Digit and Awfis also look bullish on the technical charts, with the former expected to move towards INR 400 level and the latter rallying towards INR 1,000.

lockquote>

B2B travel portal TBO Tek has also received a thumbs up from a few brokerages following its IPO. Recently, Goldman Sachs said in a research report that TBO Tek’s sector-leading revenue growth was expected to continue in the near to medium term.

“We see a long growth runway for TBO, driven by consolidation of a fragmented buyer and supplier base, coupled with TBO’s M&A led strategy,” the brokerage said.

TAC Infosec surged nearly 35% last week on its strong show in terms of customer additions in the April-June quarter and the month of July. The cybersecurity SaaS startup also announced the acquisition of US-based Cyber Sandia to bolster its presence in the US public sector market. Its financial performance and new customer additions will decide the movement of the stock going forward.

Meanwhile, the startup IPO market is expected to see more action in the remaining months of 2024. The much-awaited public offering of foodtech major Swiggy is likely to open this year, while a number of other startups like BlackBuck, Ecom Express MobiKwik, Smartworks, Avanse Financial Services, and Ullu are also awaiting SEBI’s nod for their IPOs.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)