From a mere nine deals in 2020, the ecommerce M&A activity surged to 54 deals in 2021, and 2022 saw the emergence of 59 deals before falling to 20 deals in 2023.

The Indian startup M&A space has been a victim of the declining funding trends of yesteryears, and ecommerce is no exception

Several industry stakeholders, including investors, highlighted that when funding was at an all-time high, several ecommerce companies embraced the Thrasio-style ‘house of brands’ strategy to fuel growth

Precisely a month ago, we reported that mergers and acquisitions (M&As) in the world’s third-largest startup ecosystem tanked 45% YoY to 37 deals in H1 2024. This could be largely due to investors’ muted interest in Indian startups, which attracted only $5.3 Bn, down 2% YoY, across 504 funding deals in the first six months of 2024.

A month later, Inc42’s State Of Indian Ecommerce Report H1 2024, powered by Pay10, shows that the Indian ecommerce sector witnessed a mere four M&A deals in H1 2024 versus nine in the year-ago period.

However, what’s interesting is that the number of consolidations in the segment has fallen to the pre-pandemic levels. The ecommerce segment witnessed four deals in H1 2019, before falling to just 1 M&A in the first six months of 2020, when the Indian startup ecosystem cumulatively lapped up $5.2 Bn across 391 deals.

Notably, the Indian ecommerce segment raised $824 Mn in the first half of 2019, $497 in the first six months of 2020 and $561 Mn in H1 2024.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Access The Free Report

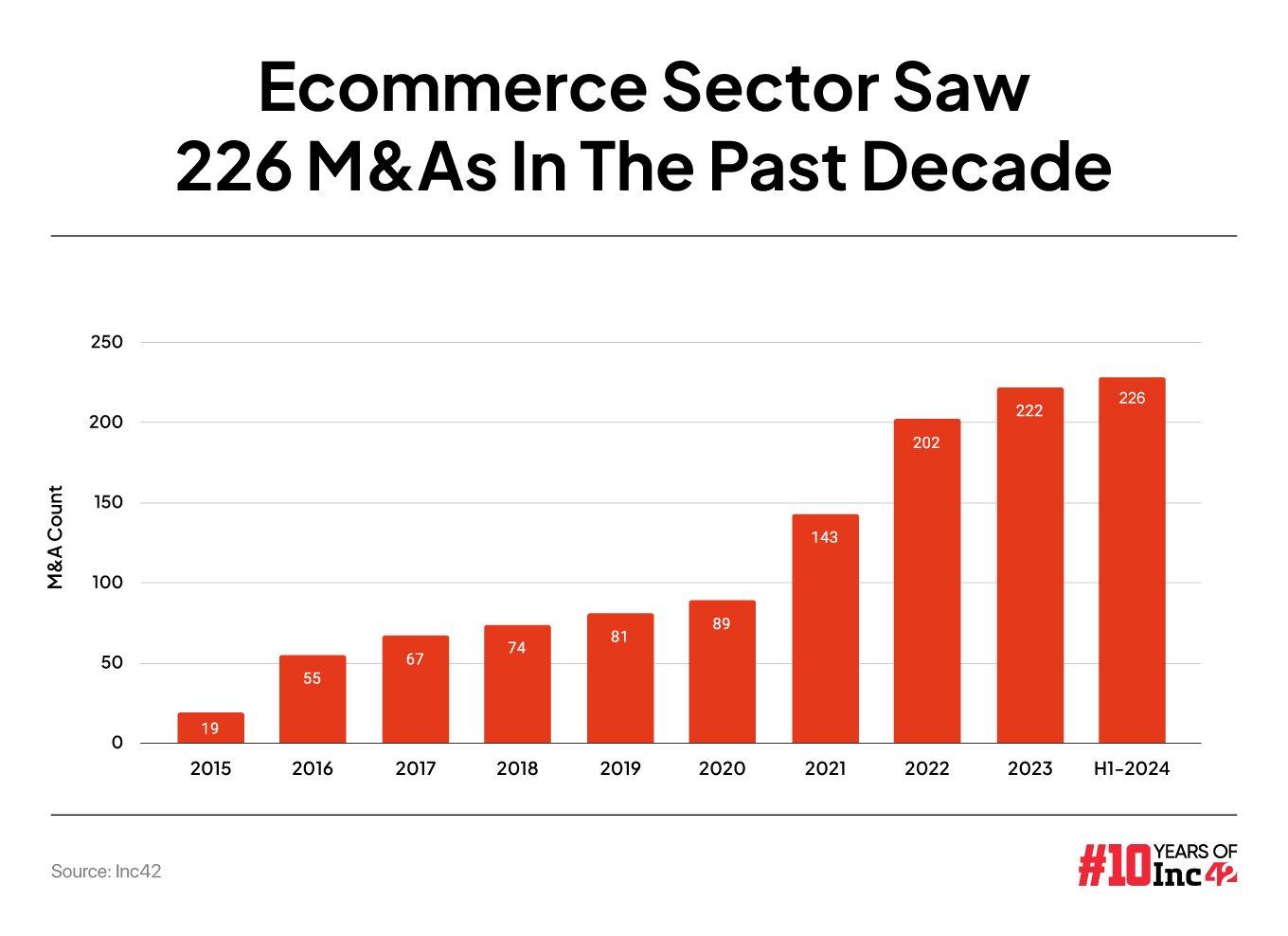

Moving on, analysing the state of Indian ecommerce M&As from a ten-year spectacle piqued our curiosity the most. Since 2014, there have been 226 M&A deals in the space.

The funding mania-fuelled post-pandemic years of 2021 and 2022 was the best period for ecommerce M&As. From a mere nine deals in 2020, the ecommerce M&A activity surged to 54 deals in 2021, and 2022 saw the emergence of 59 deals before falling to 20 deals in 2023.

Overall, the experts said, the Indian startup M&A space has been a victim of the declining funding trends of yesteryears, and ecommerce is no exception.

The Achilles Heel Of Ecommerce M&As

Speaking with Inc42, several industry stakeholders, including investors, highlighted that when funding was at an all-time high, several ecommerce companies embraced the Thrasio-style ‘house of brands’ strategy to fuel growth.

While Flipkart has been one of the leading acquirers in the space with 22 acquisitions, other big acquirers have been Mensa Brands, Globalbees, and Good Glamm Group with 17, 13 and 12 acquisitions, respectively.

As per experts, while the roll-up strategy was all the rage for ecommerce startups during the years of funding mania, the fad proved short-lived, with the startup ecosystem coming out of the pandemic only to enter the unending gloom of the funding winter.

Per WEH Ventures’ general partner Rohit Krishna, the model didn’t pan out the way it was expected, and now, the current funding environment has pushed startups to move away from acquisitions.

lockquote>

“In the current funding environment, top companies prefer to raise funds and scale independently, while less ambitious brands are more open to acquisition. This has led to a negative selection bias, where less desirable brands are available for acquisition, making the house of brands strategy less attractive,” he said.

Meanwhile, Fireside Ventures’ founding partner Vinay Singh is of the opinion that acquisitions don’t work for acquirers who lack strong core business foundations.

“For instance, if you already have an established distribution network in your core business and then acquire brands that can be integrated into that same distribution pipeline, then acquisitions as a business model might make sense. However, acquisitions without a solid core foundation are very difficult. Even the Good Glamm Group has faced its own trials and challenges in this regard,” Singh added.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Access The Free Report

Will Ecommerce M&As Pick Up Pace?

While it is difficult to predict how bright or dull the Indian ecommerce M&A arena looks in the near future, given the tryst of several companies gone wrong with the house of brands experience, there is still hope on the horizon.

Notably, players like Honasa and Nykaa that have mushroomed significantly post-pandemic, piggybacking on the ‘house of brands’ strategy, will continue to keep ecommerce M&As lucrative for many.

lockquote>

“Our in-house beauty consumer brands have experienced an [approximately] 50% CAGR from FY21 to FY24. The portfolio includes 13 brands across categories such as makeup, skincare, personal care, fragrances, and Ayurveda,” Nykaa said in its annual report for FY24.

Similarly, Honasa, which currently operates six brands – Mamaearth, Auqalogica, The Derma Co, Dr Sheth’s, BBlunt, and the recently launched colour cosmetics brand Staze — has witnessed a 20.3% increase in its product business, driven by 25.2% volume growth in Q1 FY25. Not to mention, this is the result of the house of brands strategy panning out in the right direction.

“If a few key products can drive growth and be replicated across multiple geographies and channels, and if such a business fits the portfolio of a larger conglomerate, then acquisitions are still very much on the table,” Fireside Ventures’ Singh said.

Adding to the thought, angel investor and founder of multi-platform ecommerce accelerator Assiduus, Somdutta Singh, said, “M&A activity in the ecommerce sector will see a significant uptick in H2 2024 due to improved operational performance, higher gross margins, and lower costs. Industry consolidation is expected to continue, with more substantial transactions driven by large players trying to exploit their full capabilities.”

Meanwhile, valued at over $5 Bn in 2023, the country’s BPC market is expected to become a $28 Bn+ opportunity by 2030, accounting for 7% of the overall ecommerce market.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Access The Free Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)