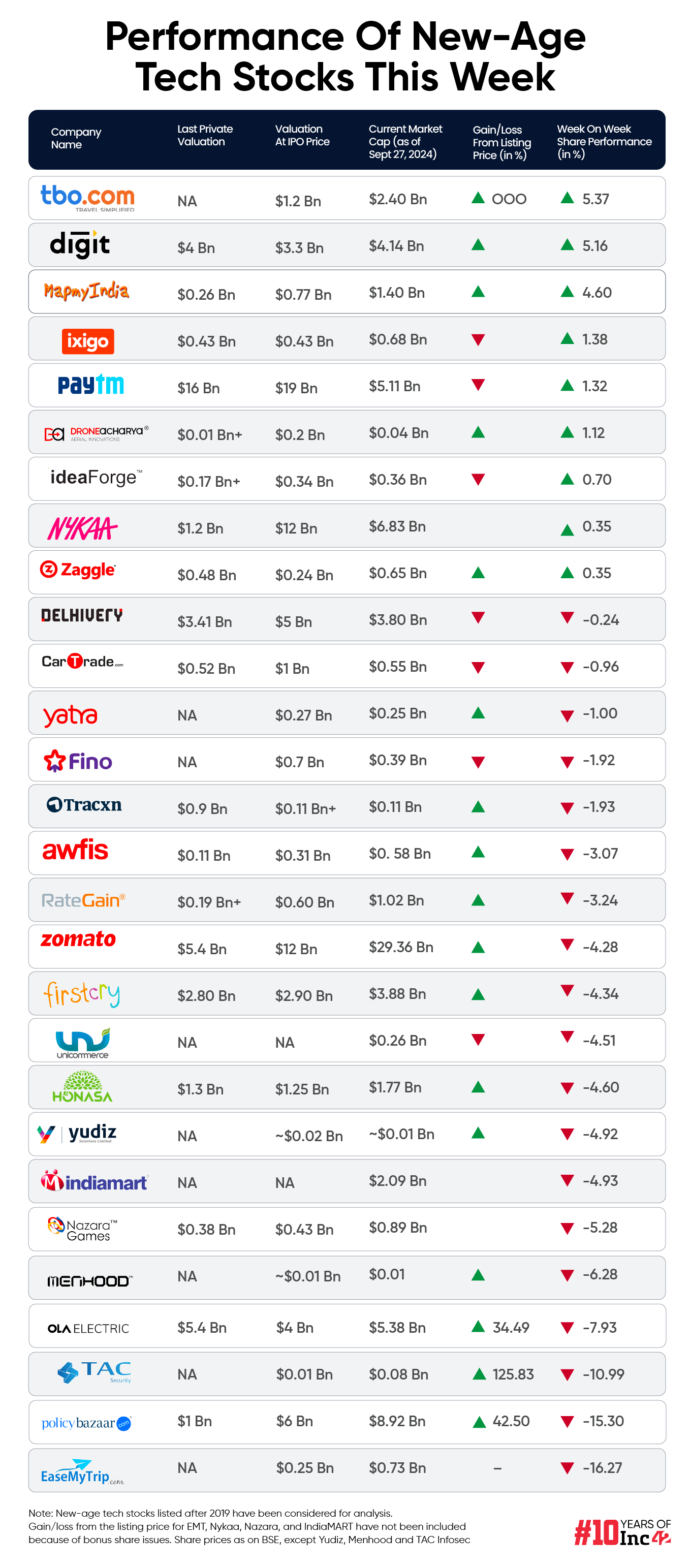

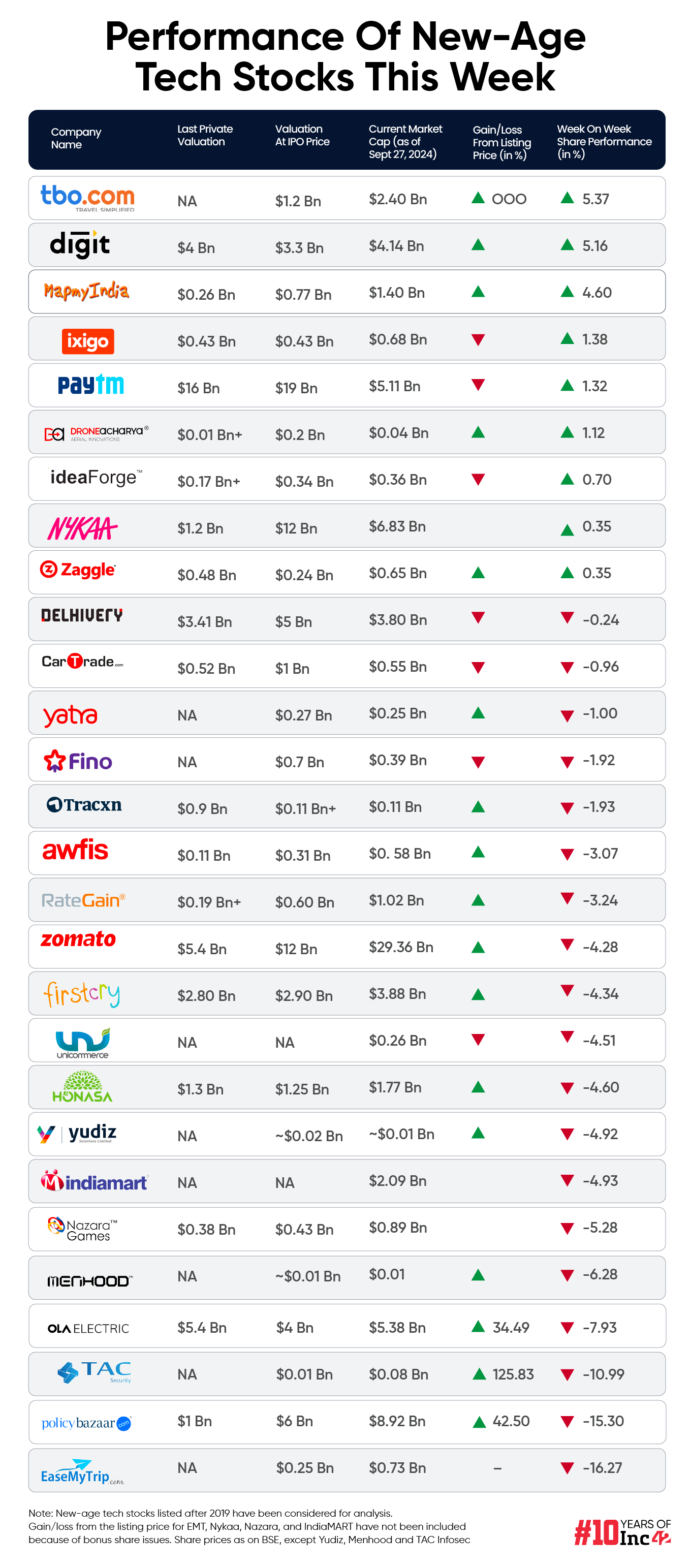

Even as the broader market continued to rally, a majority of the new-age tech stocks ended in the red this week. Nineteen of the 28 stocks under Inc42’s coverage fell in a range of 0.2% to over 16% this week.

Travel tech startup EaseMyTrip emerged as the biggest loser as its cofounder and CEO Nishant Pitti offloaded almost half of his stake in the startup. The stock ended the week 16.27% lower at INR 34.85 on the BSE.

Fintech major PB Fintech was the second-biggest loser. After hitting a fresh all-time high last week, the stock ended this week 15.3% lower at INR 1,638.75 on the BSE.

Zomato, Ola Electric, TAC Infosec and Nazara Technologies were among the other losers this week.

Meanwhile, travel tech startup TBO Tek emerged as the biggest gainer this week. Its shares ended the week 5.37% higher at INR 1,853.8.

Including TBO Tek, nine new-age tech startups gained in a range of 0.35% to over 5% this week. Go Digit, ixigo, Paytm, MapmyIndia, Nykaa, DroneAcharya, Zaggle, and ideaForge were the other gainers this week.

The broader domestic market continued its upward march for the fourth consecutive week. Benchmark indices Nifty50 and Sensex hit fresh all-time highs on Thursday (September 26), zooming to 26,087 and 85,462, respectively.

While Sensex ended the week 1.2% higher at 85,571.85, Nifty50 gained 1.5% to end at 26,175.15. The Fed rate cuts and stable economic data points continued to drive the bull run during the week.

Commenting on the market performance, Vinod Nair, head of research at Geojit Financial Services, said, “A visible trend is that this rally was predominantly led by large cap stocks, which are relatively fairly valued compared to mid and small caps, which are showing signs of exhaustion. A risk to the rally is elevated valuations.”

It is pertinent to note that except Zomato, the rest of the 27 tech stocks under Inc42’s coverage are all mid and small cap stocks.

Moving forward, Nair believes that investors will be focusing on the Q2 earnings.

Meanwhile, Hrishikesh Yedve, AVP of technical and derivatives research at Asit C. Mehta Investment Interrmediates, said that the rally is likely to continue in the short term.

“Technically, the weekly scale index has formed a big green candle. Moreover, the index on a weekly scale has managed to close above the breakout of the rising channel pattern, indicating strength. In the short term, as long as Nifty holds above the breakout level of 26,000, a “buy on dips” strategy should be adopted. On the upside, 26,500 will be an immediate short-term target for the index,” he added.

It is worth noting that the Indian startup ecosystem is set to witness two much-awaited public market debuts. This week, foodtech major Swiggy filed its updated draft red herring prospectus (DRHP) with the Securities and Exchanges Board of India (SEBI), while fintech unicorn MobiKwik received the market regulator’s approval for its IPO.

The fintech unicorn is set to raise INR 700 Cr from its IPO, which comprises only a fresh issue of equity shares. Meanwhile, Swiggy’s proposed IPO comprises a fresh issuance of shares worth INR 3,750 Cr and an offer for sale (OFS) component of 18.53 Cr equity shares.

If and when the two IPOs materialise, the total count of new-age IPOs this year will zoom up to 12.

“As global markets recalibrate after 2021’s peak, India is stepping into the spotlight with unprecedented vigour. This year, the Indian IPO market is poised for a significant leap, with large corporations in IPO Street, demonstrating growing investor confidence in the Indian market. Both local and international investors are driving this momentum, and all signs point to continued growth and opportunities ahead,” Pantomath Capital Advisors said.

With that said, let’s take a deeper look at the performance of the new-age tech stocks this week.

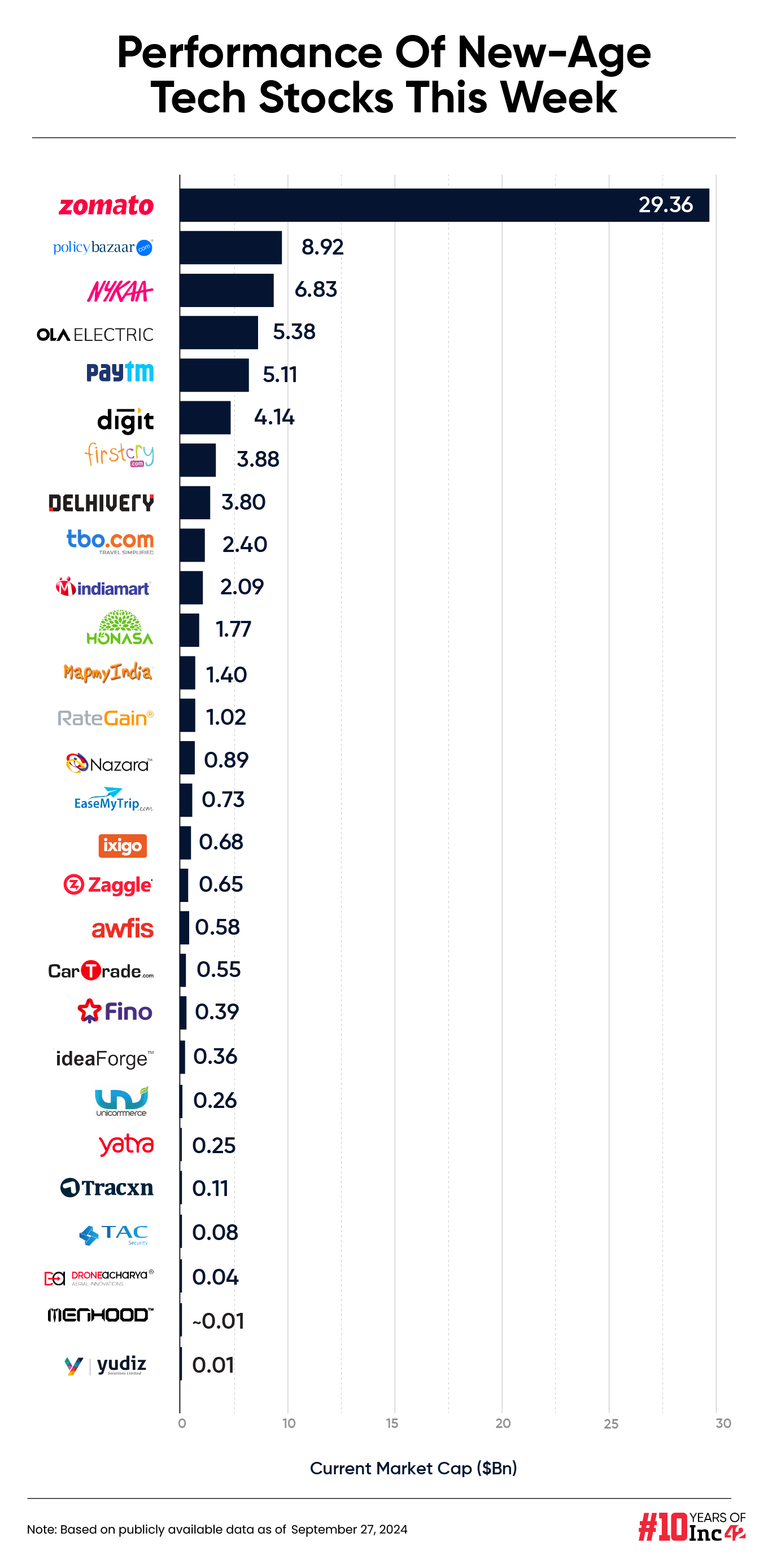

The total market capitalisation of the 28 new-age tech stocks under Inc42’s coverage dipped to $81.69 Bn at the end of this week as against $85.49 Bn last week.

Paytm Continues Its Bull Run

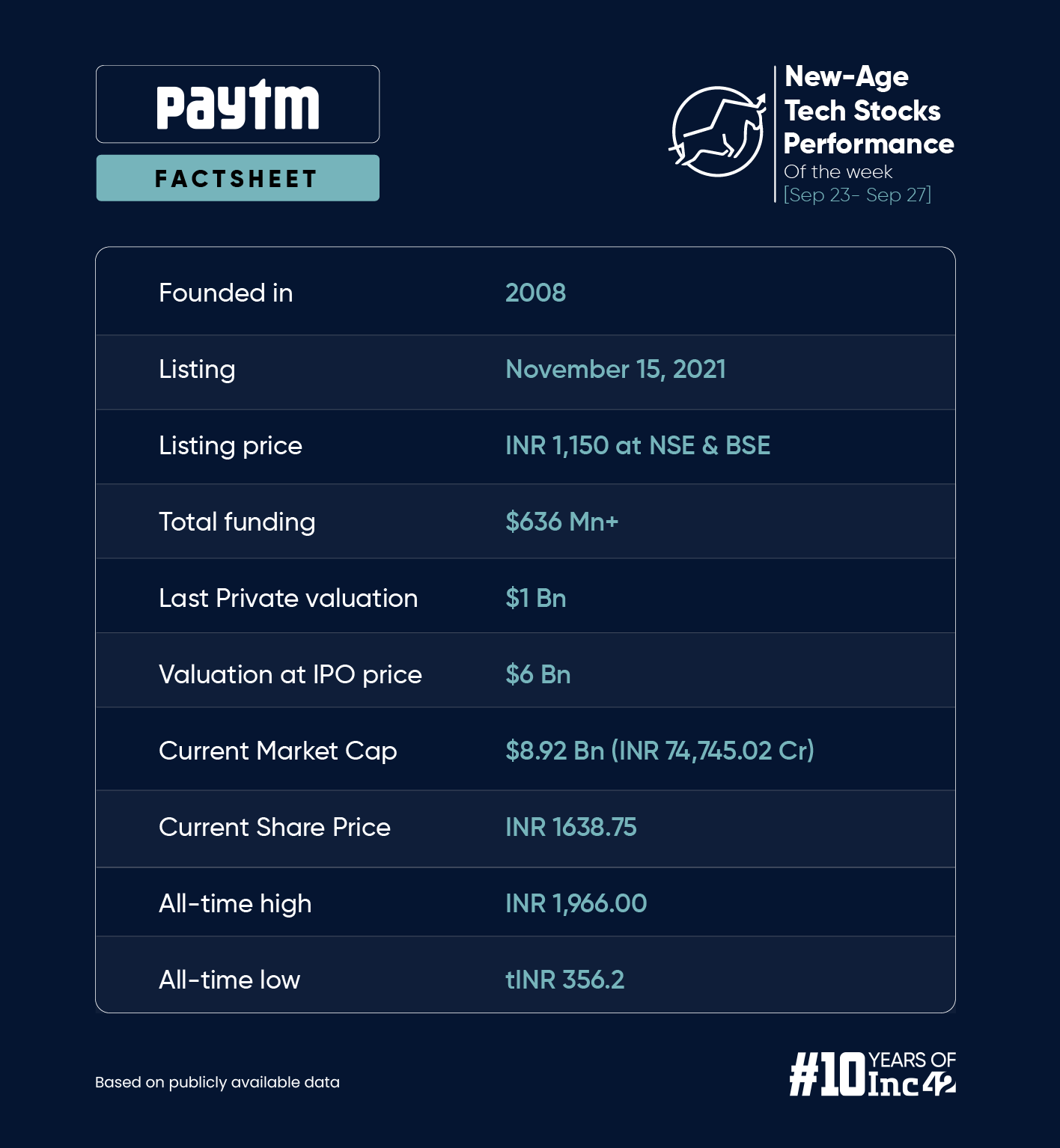

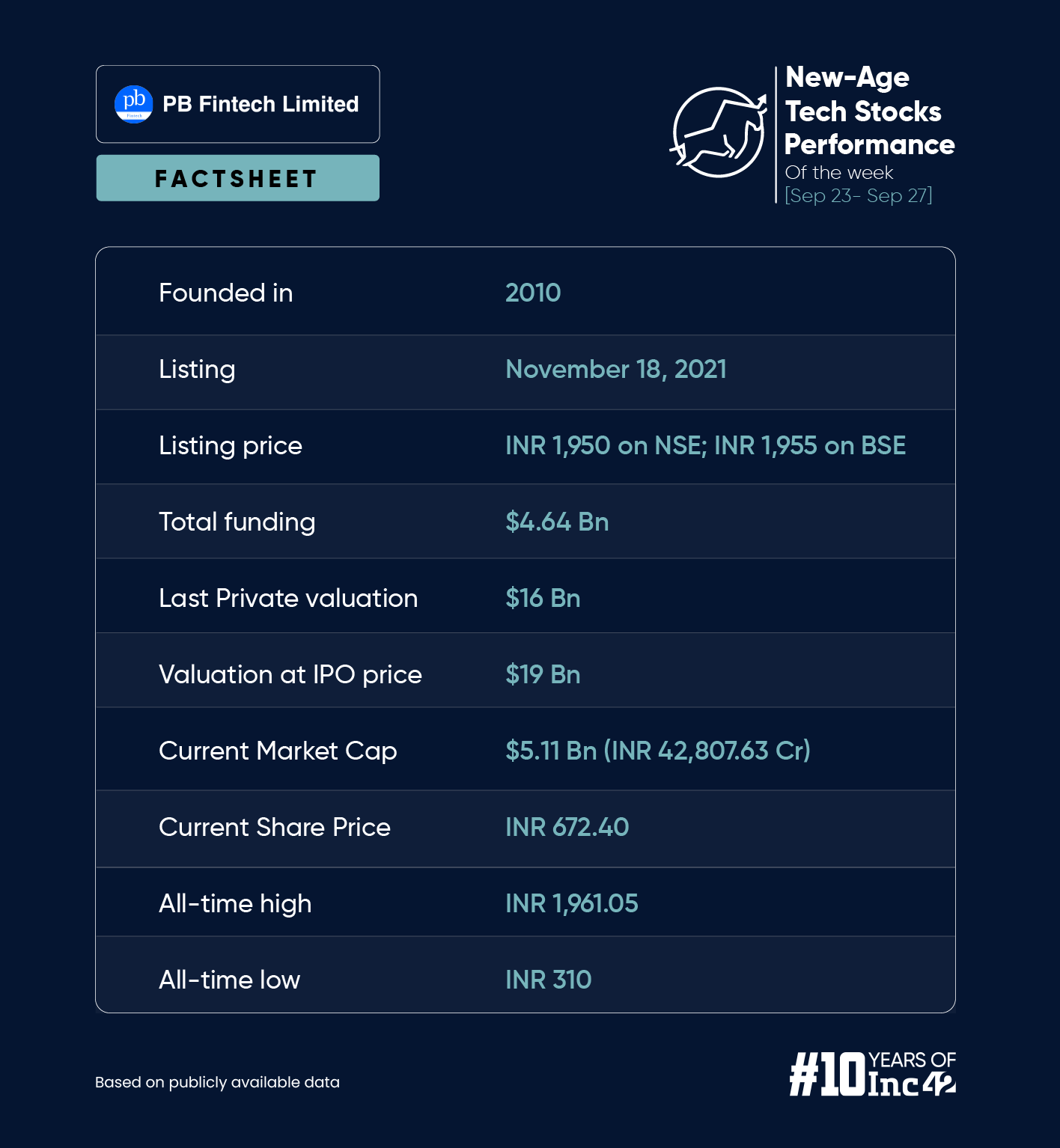

After a significant dip in its share prices earlier this month, fintech major Paytm has been on a slow and steady upward movement on the bourses.

After slipping to the INR 325 level in February, shares of the startup have more than doubled in seven months. Shares of Paytm ended this week 1.32% higher at INR 672.4 on the BSE.

Recently, brokerage firm Emkay Global changed its rating on the stock to ‘add’ from ‘reduce’. It also raised Paytm’s price target (PT) to INR 750 apiece from INR 375 earlier.

The brokerage believes that Paytm’s loan distribution business will gradually reaccelerate and pointed out that its broking and insurance distribution business has already turned profitable.

Further, it also said that the sale of its “heavy” movies and events ticketing business to Zomato is also expected to pay dividends in the remainder of the ongoing fiscal, as it will add on to its cash reserves and reduce net loss.

For the first time since the RBI slapped restrictions on Paytm Payments Bank earlier this year, the stock touched a price of INR 724.85 during the intraday trading mid-week.

However, it is pertinent to note that Paytm shares are still trading 65.61% lower than their listing price. Speaking about the startup’s listing in November 2021, Paytm CEO and founder Vijay Shekhar Sharma recently lamented the choice of the investment bankers.

“I have been an entrepreneur long enough now. I have a regret of not choosing the correct bankers for the IPO,” Sharma said during Tie Delhi NCR’s India Internet Day 2024 on Friday (September 27).

ICICI Securities, JP Morgan, Goldman Sachs, Morgan Stanley, HDFC Bank, and Citi were its investment bankers.

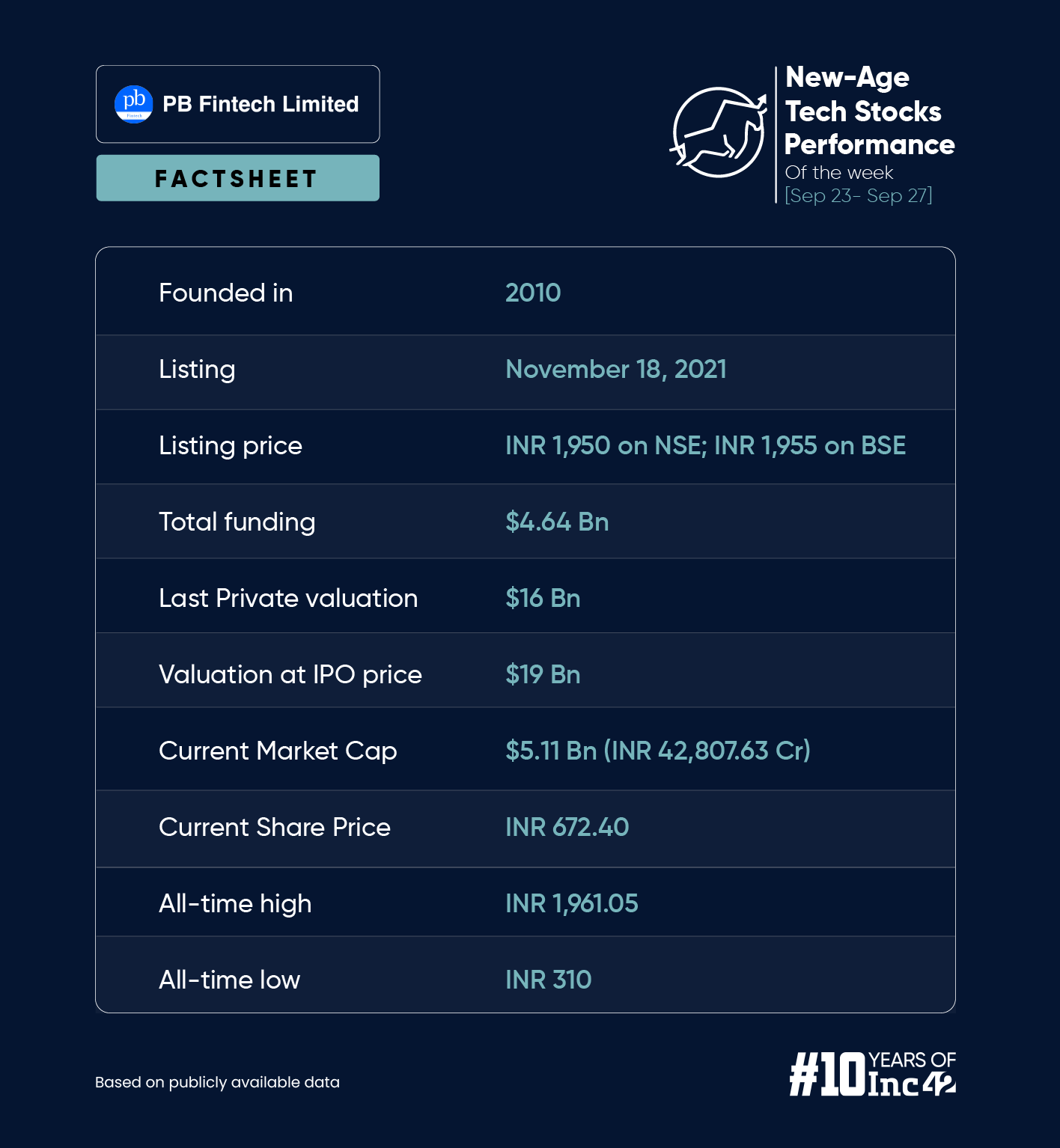

PB Fintech Dips After Report Of Foray Into Healthcare Sector

After touching an all time high of INR 1,966 on September 20, shares of the fintech major witnessed a downward spiral to end the week at INR 1,638.75. This marked a 15.3% decline in its share prices on a week-on-week basis.

The selling pressure came after CNBC-TV18 reported about the company’s plans to foray into the healthcare sector on Wednesday (September 25). The report cited sources as saying that the startup is exploring plans to venture into the healthcare sector by establishing its own chain of hospitals.

“This move aims to unlock new value within the healthcare ecosystem, diversifying the company’s portfolio beyond its current focus on insurance and financial services,” the report said.

As the stock came under pressure following the report, PB Fintech issued a clarification stating the company has not confirmed any plans as of now. Further, it said that it will intimate the bourses “if and when” it arrives on a decision around its healthcare foray.

“We believe if claims were a quicker and smoother experience it would increase the number of people buying health insurance. It would be much better if interests were aligned between insurers and hospitals to give customers amazing claims experience and we believe that would grow insurance penetration,” the company said.

Meanwhile, Morgan Stanley said after the healthcare report that it is premature to evaluate any potential financial effects from PB Fintech’s healthcare venture since the management has not shared any additional details. The brokerage believes that investor sentiment regarding the stock will largely hinge on the scale of the capital expenditure – whether it is a one-time cost or an ongoing commitment.

The brokerage retained its ‘equal-weight’ rating on the stock with a PT of INR 1,375.

BofA also recently upheld a ‘Neutral’ rating on PB Fintech, setting a PT of INR 1,975.

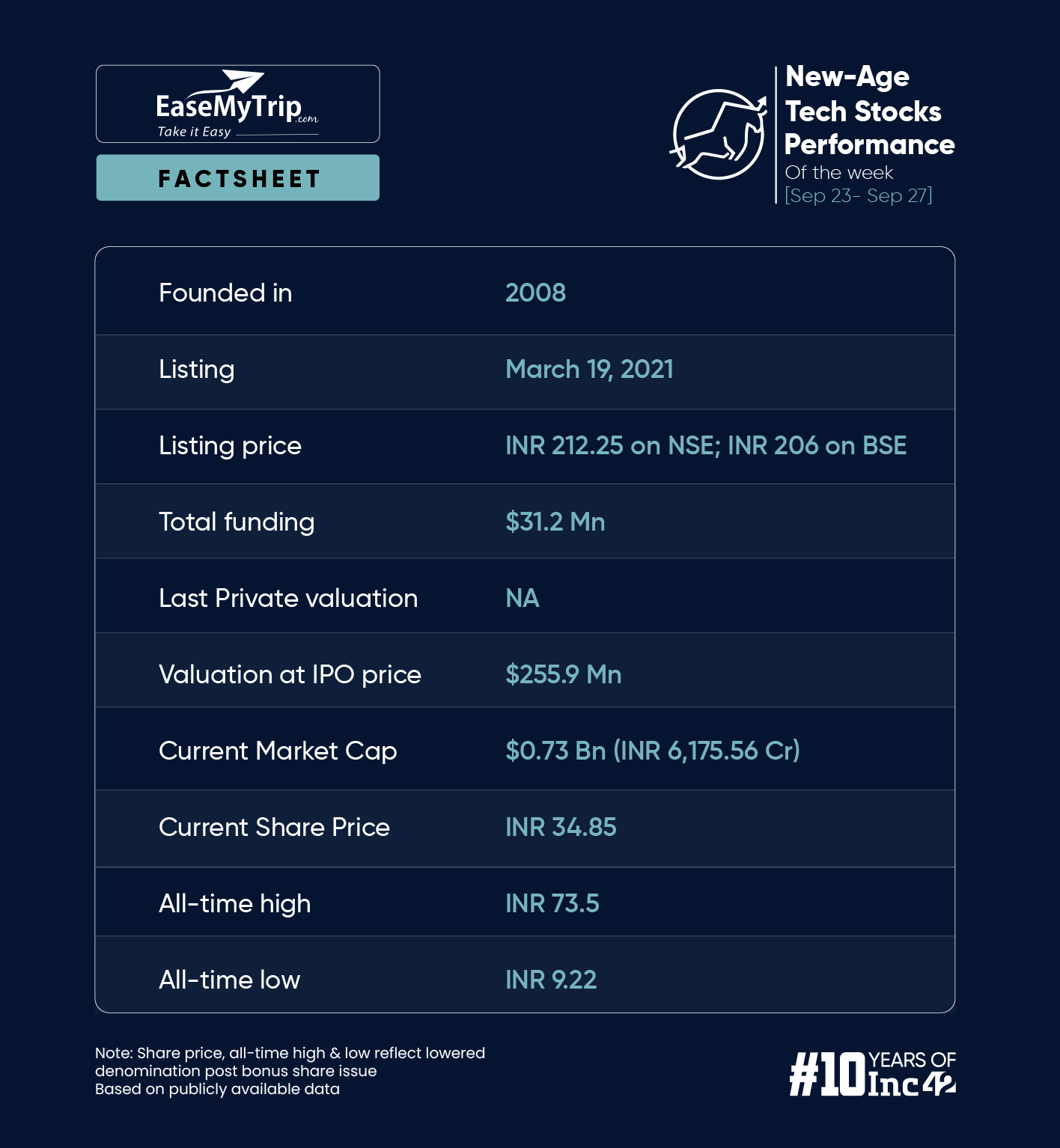

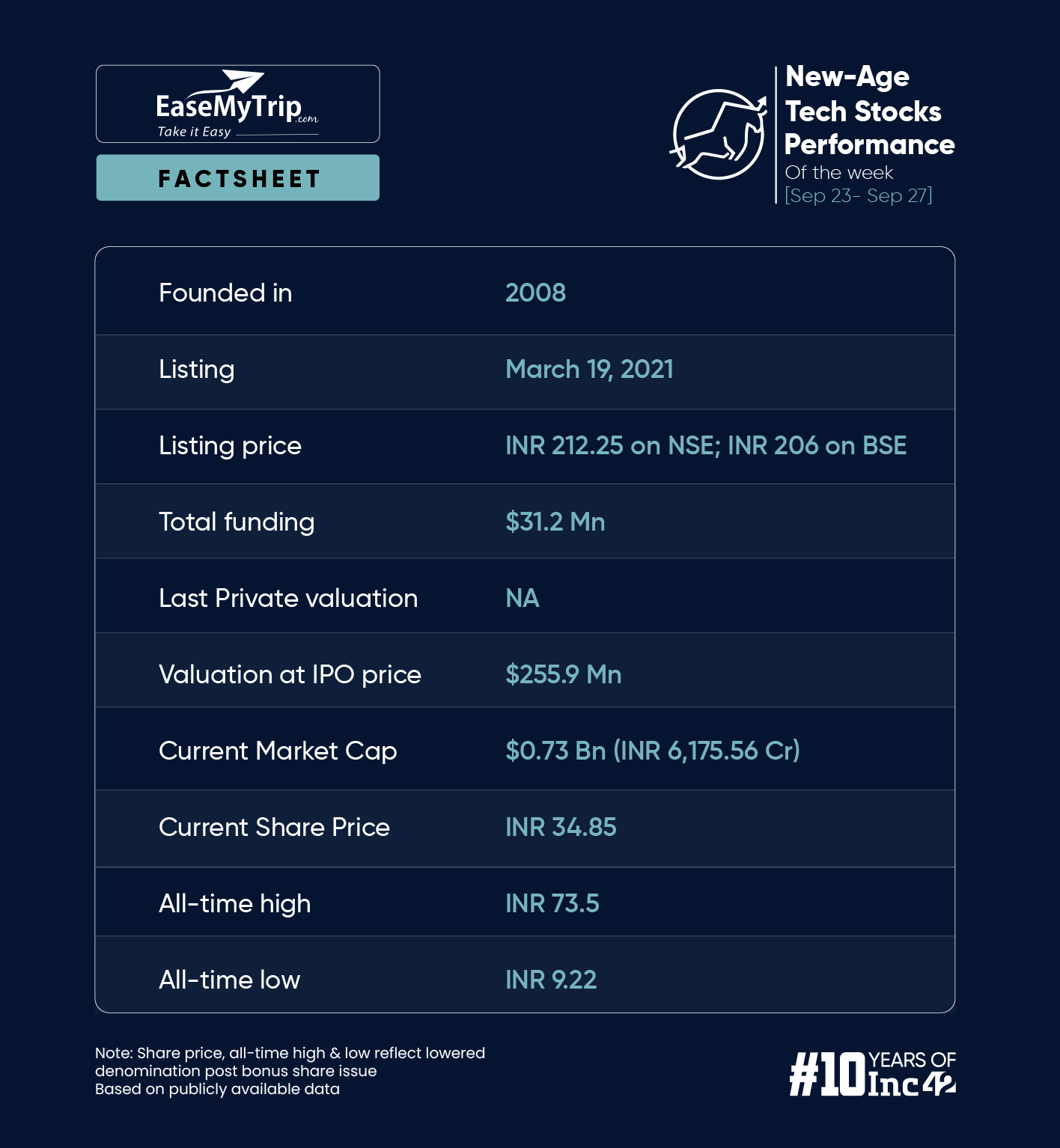

EaseMyTrip Tanks As Founder Reduces Stake

Shares of EaseMyTrip closed 16.27% lower at INR 34.85 this week. The shares plummeted to touch the lower circuit at INR 32.78 apiece mid-week amid major block deals in the company.

This led to its market cap falling to $737.65 Mn at the end of this week from over $880 Mn last week.

On September 25, EaseMyTrip CEO Nishant Pitti sold 24.65 Cr shares in the startup through multiple block deals worth INR 920 Cr.

Pitti’s stake in the travel tech startup decreased to about 14% from over 28% at the end of the June quarter, when he held 49.84 Cr shares.

However, the startup also made a few other announcements this week. This included EaseMyTrip’s exclusive partnership with PhonePe to launch its “hotels segment” on the fintech platform, which would allow PhonePe users to access services such as hotel deals, special offers, and cab services.

Last week, the company revealed plans to acquire a 30% stake in Rollins International Private Limited for INR 60 Cr ($7.15 Mn) and a 49% stake in Pflege Home Healthcare Center LLC for INR 30 Cr ($3.5 Mn).

Shares of EaseMyTrip are trading 14.13% lower year to date.