Even Kishore Biyani is not sure about how Meesho

At Inc42’s D2C Summit in August this year, the Future Group founder and retail industry veteran admitted that he is flummoxed by how Meesho cracked the ecommerce code to compete with Amazon India and Flipkart.

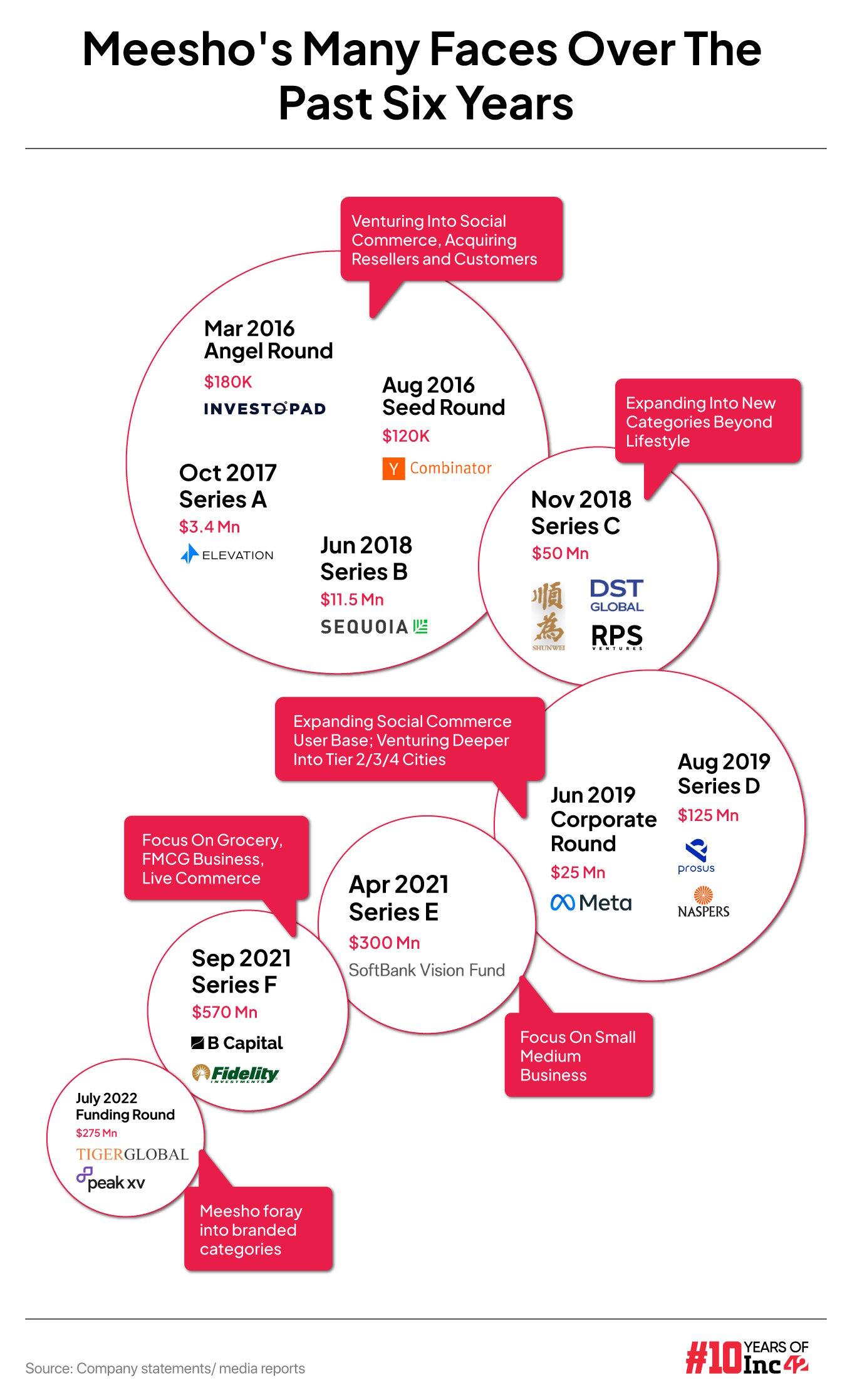

The SoftBank-backed company’s GMV growth has put it right up there with the two biggest marketplaces in India. And now Meesho is pushing the accelerator and taking them on in the branded category after making a name in the unbranded consumer goods space.

Despite its zero commission model, Meesho has scaled up its revenue by relying on advertising and marketing income from sellers, and a discounts-led acquisition strategy on the consumer side. Besides this, the company charges a fulfilment fee from sellers for completing deliveries using its multiple logistics providers.

lockquote>

The Vidit Aatrey-led company claimed it turned profitable in July 2023 “at a consolidated PAT level, encompassing all costs (including ESOP)” which underlines how Meesho has transformed itself in the past two years from its social commerce model and its slew of experiments to its current avatar.

We cannot say whether the profitability streak continued for the rest of FY24. The company is yet to file its financials for the year ending March 2024. But if Meesho has indeed hit profitability, it would be quite an achievement in the context of horizontal marketplaces in India.

In fact, the company is said to be in the process of raising a large round of $500 Mn-$650 Mn and could potentially look to redomicile to India and go for an IPO.

But before it gets there, Meesho has to make one final push and bring on more retail FMCG brands and D2C players to its platform. That’s the idea behind Meesho Mall, which got a big overhaul ahead of the festive season and is now ready for prime time.

Meesho Mall: From Unbranded To D2C

Launched in 2022, Meesho Mall was the company’s foray into the branded category and it started out with beauty and personal care products.

Last month, the marketplace announced brand tie-ups with the likes of Honasa, Denver Perfumes, Himalaya, Bajaj, Joy, Lotus Herbals, Biotique, Bata, Paragon among others in the BPC, fashion and home decor categories.

The list of brands indicates that Meesho is looking to target those brands which not only have an established online presence, but also those which are more likely to connect with Meesho’s core audience base in India’s hinterlands and outside the metros.

“These partnerships are designed to ensure that customers have access to the best products from both well-known and emerging brands, all under one roof. In the last six months alone, Meesho Mall has seen 3.2 Cr shoppers, reflecting growing consumer trust in the platform,” Megha Agarwal, CXO-Business at Meesho, said in an earlier statement.

The Meesho Mall product was unable to produce the right revenue outcomes in the first couple of years, according to analysts, as can be expected with any marketplace. It takes a while to put in place the virtuous cycle of consumers and sellers.

lockquote>

A Meesho spokesperson claimed that since launch, Meesho Mall has partnered with over 1000 brands in high-value categories including electronics, personal care, beauty, home and kitchen, wellness and branded fashion.

It has taken some time for the company to get its core and active users to get familiar with these brands and their USPs vs similar products in the unbranded category. Naturally, the price is a major sticking point for consumers habituated to Meesho, since unbranded goods are several times cheaper than their branded counterparts.

“Even though Meesho was the most downloaded shopping app in 2022 and 2023, according to Sensor Tower, that was primarily because it was the user base that was new to ecommerce, mostly from Tier 2, 3 towns. Meesho managed to get a lot of downloads from these users,” according to Satish Meena, advisor at Datum Intelligence.

lockquote>

With the revamped Meesho Mall, the company is looking to capitalise on this base. But in this case, Meesho will obviously have to shed its zero commission model.

It remains to be seen how competitive Meesho’s commission rates are in comparison to other platforms. Sources claimed the company will charge single digit commissions from sellers on the Meesho Mall.

Meesho’s Moat Against Amazon, Flipkart

For D2C brands that rely on marketplaces such as Amazon India, Walmart-owned Flipkart and even Meesho, the biggest challenge is the commission model, the lack of access to data around their customers as well as the inability to have a say in the customer experience. In particular, brands are wary of Amazon or Flipkart using analytics data related to their products to launch private labels or products under their private labels.

Through various regulations and by building pressure through lobbying, brands have forced marketplaces to curb some of these practices. Plus, the emergence of quick commerce has given brands a lucrative online channel and reduced their reliance on marketplaces.

Meesho will face these challenges as well, but it’s counting on the fact that it connects to an audience base that is altogether different from Amazon or Flipkart.

“Through our extensive user research, we understood that our consumers are searching for branded products across categories, especially where salience of brands is typically higher. Furthermore, several brands also expressed a strong intent to partner with us and leverage our capabilities in serving over 160 Mn annual transacting users, particularly in tier 2+ markets,” the Meesho spokesperson added.

lockquote>

Raju Sinha, CBO of ecommerce logistics company FShip, believes that unlike Amazon India or Flipkart, Meesho’s is the preferred choice for D2C brands looking to connect with consumers in Tier 2/3 India. These brands do not want the overheads of supply chain costs and high acquisition costs for users in these semi-urban markets.

More than 80% of Meesho’s shopping revenue came from Tier 2, 3 cities which are relatively uncharted territories for new-age D2C brands.

“This is a win-win situation for D2C brands and Meesho. D2C brands like Honasa, SUGAR, Renee Cosmetics and others explored offline channels to reach Tier 2 markets, but the retail landscape is so fragmented in these regions that brands don’t know which trade channels to invest in,” he added.

lockquote>

On the other hand, legacy brands know the dynamics of retail channels in semi-urban India, and this has allowed them to earn trust among consumers. Meesho has built that trust online, and now it’s transferring some of that trust to the D2C brands now coming on board.

The key will be user retention, providing a wide catalogue of products and categories and staying competitive on the pricing.

“At this point, growing the topline by ensuring the users continue buying from the marketplace by giving them more choices and also ensuring they offer competitive prices will be crucial. The new to ecommerce users which Meesho onboarded over the last few years are now looking to shop from other channels which could be Ajio, Myntra, Amazon Fashion and others. Meesho wants to stop this migration, and is therefore targeting mid-priced Indian brands on the platform,” Meena added.

lockquote>

At the same time, Meesho has to cater to the premiumisation sentiment within its audience base, if it has to drive up the average order value. The AOV for Meesho is around INR 400, compared to INR 1,200 for Flipkart or Amazon in fashion and BPC alone. The latter two have a much bigger lead in electronics, consumer durables and other categories.

Meesho will also look to amp up its advertising, marketing revenue by getting these brands to advertise on its platform now that it has reached more than 160 Mn transacting users.

“Ecommerce advertising has outshined even Google, Meta ad business growth rates. Amazon , Flipkart and Meta have substantially increased their advertising charges, which almost becomes unsustainable for homegrown smaller brands. Meesho’s scale and reach might be a better alternative,” the founder of a D2C athleisure brand who is considering listing on Meesho claimed.

Pricing, Logistics Will Be Key

On the pricing front, Meesho will not have the flexibility of offering high discounts on products like it does on the unbranded side. The company may have to strike a deal with D2C brands to offer discounts and this could hamper some of the growth on that side of the marketplace.

To counter this, Meesho might rely on Valmo, its in-house product for logistics aggregation. However, a key challenge would be to create pan-India coverage through this model.

“With the launch of Valmo, Meesho brought in a franchise-based and asset-light logistics model suited for Indian brands. It has made the company more logistics efficient and reduced costs associated with paying third-party players. Each franchise centre is given out several pincodes to serve from where they fulfil delivery and returns,” FShip’s Sinha added.

lockquote>

Industry insiders also believe entering into discounting deals with Meesho will not be a bad thing for brands, since Meesho will offset this with lesser commissions.

“Meesho cannot completely change its image of affordability which has been a distinguishing feature of the platform. Hence agreements with brands will be key. Mostly D2C will be willing to offer discounts on Meesho since the platform charges them lesser commissions. This will help attract users,” Meena added.

Can Meesho Become The Online Zudio?

Elara Capital partner Karan Taurani believes that Meesho’s attempt to lure low-priced, mid-priced brands is similar to what Tata-owned Zudio has done in offline retail.

It caters to the fashion-aware Generation Z and millennial audiences in metros and even Tier 1/ 2 cities. It has strategically set up stores in smaller cities to increase consumer awareness.

Like Zudio, Meesho’s focus is on volume and not order value. Taurani foresees Meesho acquiring some D2C brands and investing in private labels like Amazon and Flipkart have done. This will help capitalise on user trust and maximise profitability.

“Even as private label brands account for only 10% of sales for marketplaces in each category, they play a crucial role in shoring up the revenue base. Meesho could look at acquisition, consolidation strategies with some of these D2C brands to grow business in the long term in branded categories,” Taurani added.

lockquote>

The elephant in the room is quick commerce and how the likes of Blinkit, Zepto and Swiggy have entered the marketplace territory. The company has not yet spoken about making a re-entry into grocery or potentially a quick commerce launch. It will be interesting to see whether quick commerce will be part of Meesho Mall’s roadmap if and when the company raises funds.

It’s taken a few years, but Meesho seems to have cracked the code indeed. Will this hot streak continue well after the festive season?

[Edited By Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)