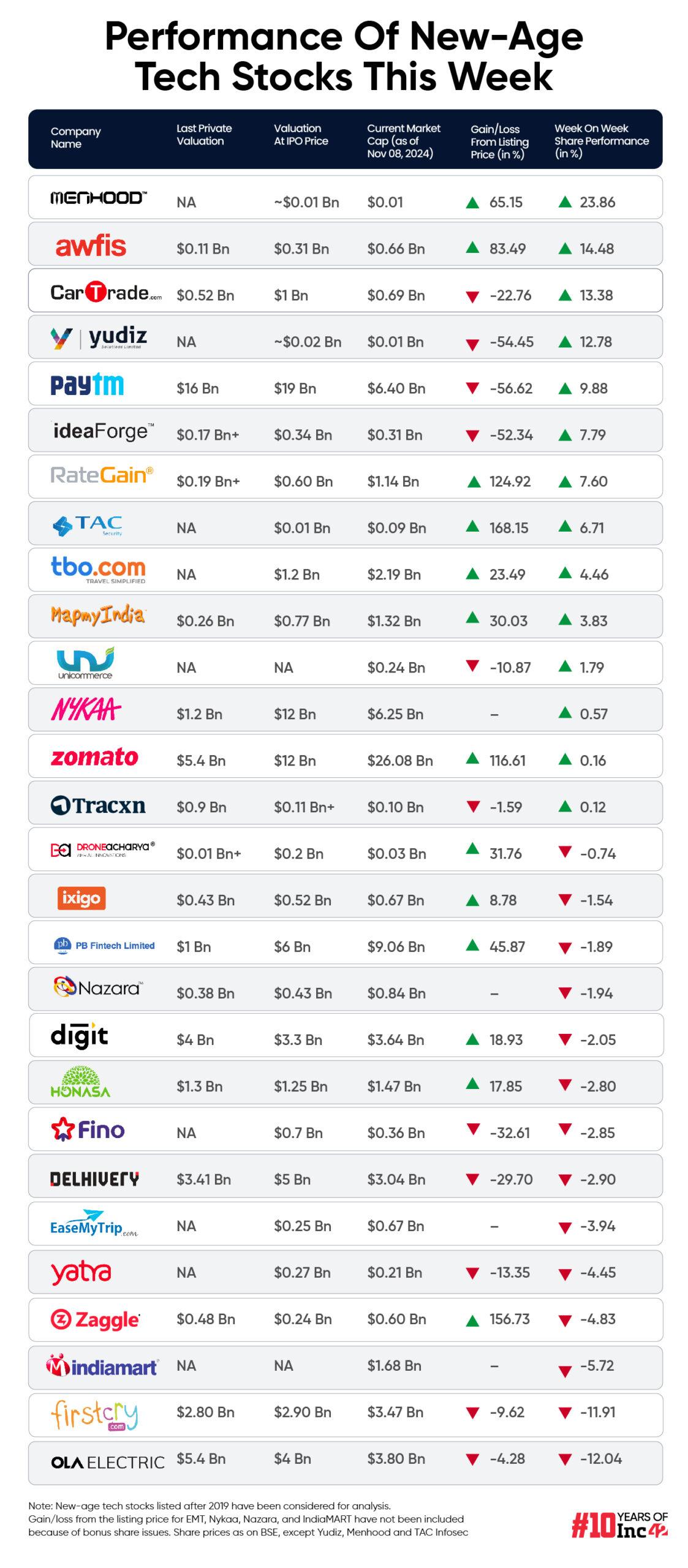

The ongoing earnings season, presidential elections in the US, geopolitical tensions, among others, resulted in an extremely volatile week for the Indian equities market. Amid all these, new-age tech stocks experienced a mixed week.

Fourteen out of the 28 new-age tech stocks under Inc42’s coverage rose in a range of 0.12% to just under 24% this week. NSE Emerge-listed D2C brand Menhood emerged as the top gainer this week, with its shares climbing 23.86% to end at INR 158.55.

The shares of Menhood’s parent Macobs Technologies rallied to an all-time high of INR 167 on November 7. The company’s market capitalisation jumped to $18.4 Mn at the end of the week.

Awfis, Paytm, Rategain, Unicommerce, Zomato were among the other gainers this week.

Meanwhile, 14 new-age tech stocks ended the week in the red, falling in a range of 0.74% to a bit over 12%. Shares of electric two-wheeler manufacturer Ola Electric continued their free fall this week. The company’s shares ended the week at INR 72.74, down 12.04% from the previous week.

Delhivery, Go Digit, Honasa Consumer, IndiaMART InterMESH, Yatra, among others, also ended the week in the red.

In the broader market, Sensex gained 0.65% to end the week at 79,486.32 and Nifty 50 rose 0.31% to 24,148.20.

While the markets went down significantly at the beginning of the week, Donald Trump’s victory in the US presidential election injected optimism in the middle of the week.

Commenting on the performance this week, Geojit Financial Services’ head of research Vinod Nair said that the market continued to experience consolidation due to heightened selling pressure from foreign institutional investors (FIIs) over concerns about weak corporate earnings and premium valuations.

The shareholding of foreign investors in NSE-listed companies dropped to a 12-year low of 15.98% last month. However, there is optimism about the future.

“This year, government spending is expected to be backended due to general elections. So, there are expectations of improved corporate earnings in H2 FY25. The festive season in Q3 is likely to revive consumption, which should support market sentiment and will aid in finding a floor in the near future,” Nair said.

Meanwhile, the IPO of foodtech major Swiggy closed on Friday. The issue received bids for 57.53 Cr shares as against 16.01 Cr shares on offer, resulting in 3.59X subscription. The IPO comprised a fresh issue of shares worth INR 4,999 Cr and offer for sale (OFS) of 17.5 Cr shares. Shares of Swiggy are expected to get listed on Wednesday (November 13).

Ahead of the public listing, Bajaj Broking and SBI Securities recommended subscribing to the issue with a long-term investment perspective. InCred Equities recommended subscribing to the offer given that Swiggy’s valuation is at a discount to Zomato.

Now, let’s take a deeper look at the performance of the new-age tech stocks this week.

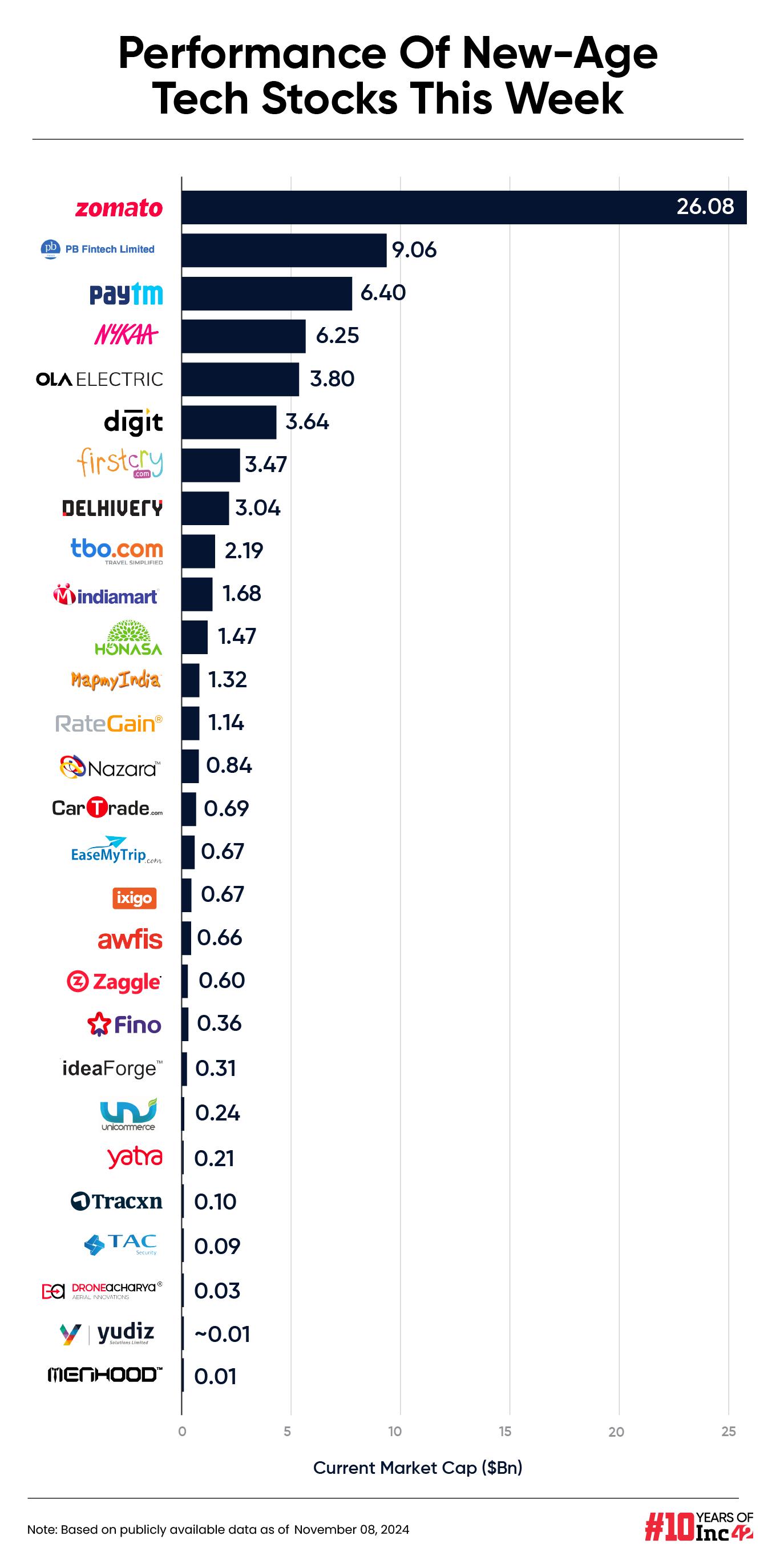

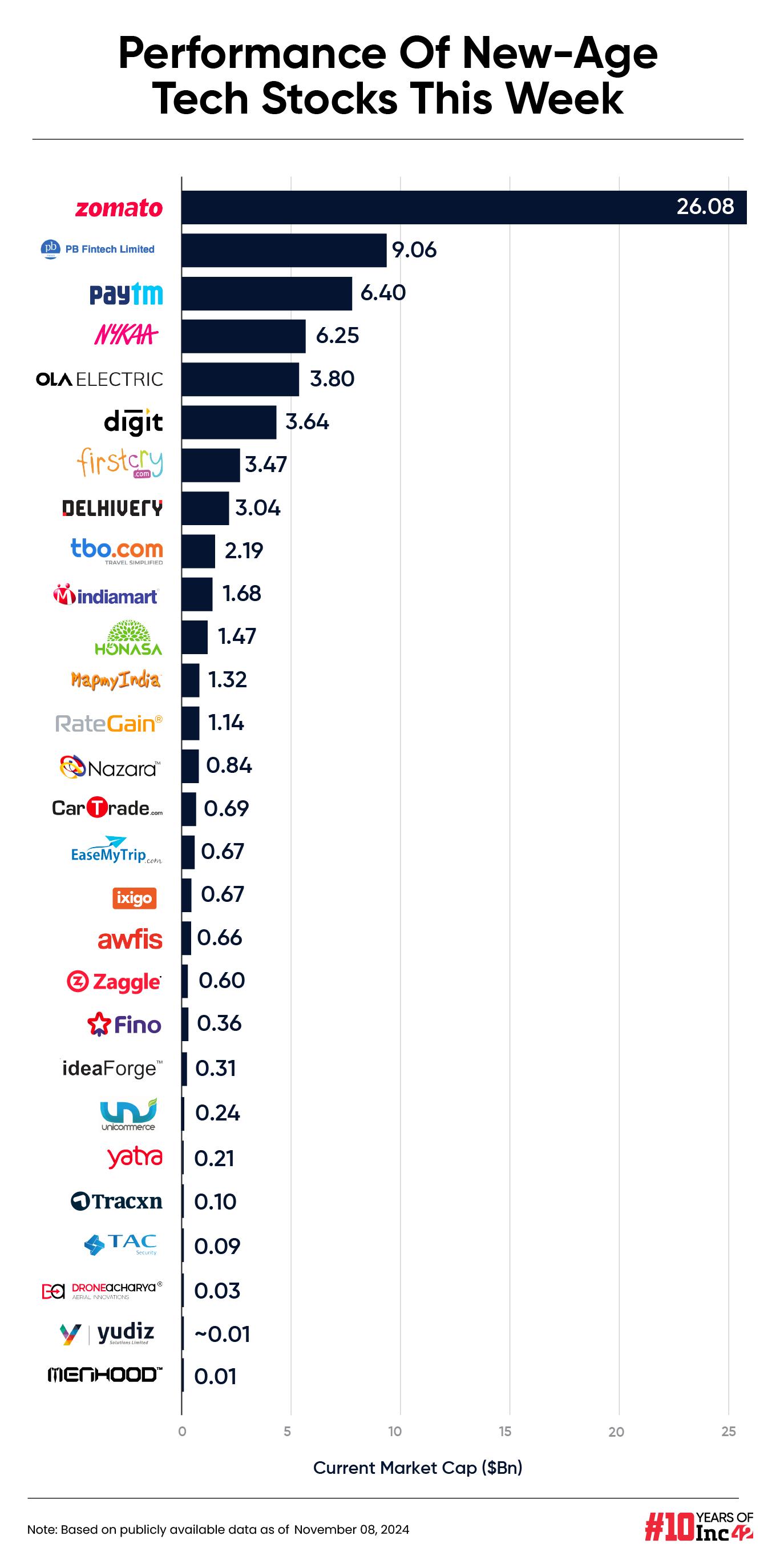

The total market capitalisation of the 28 new-age tech stocks under Inc42’s coverage stood at $75.03 Bn at the end of this week.

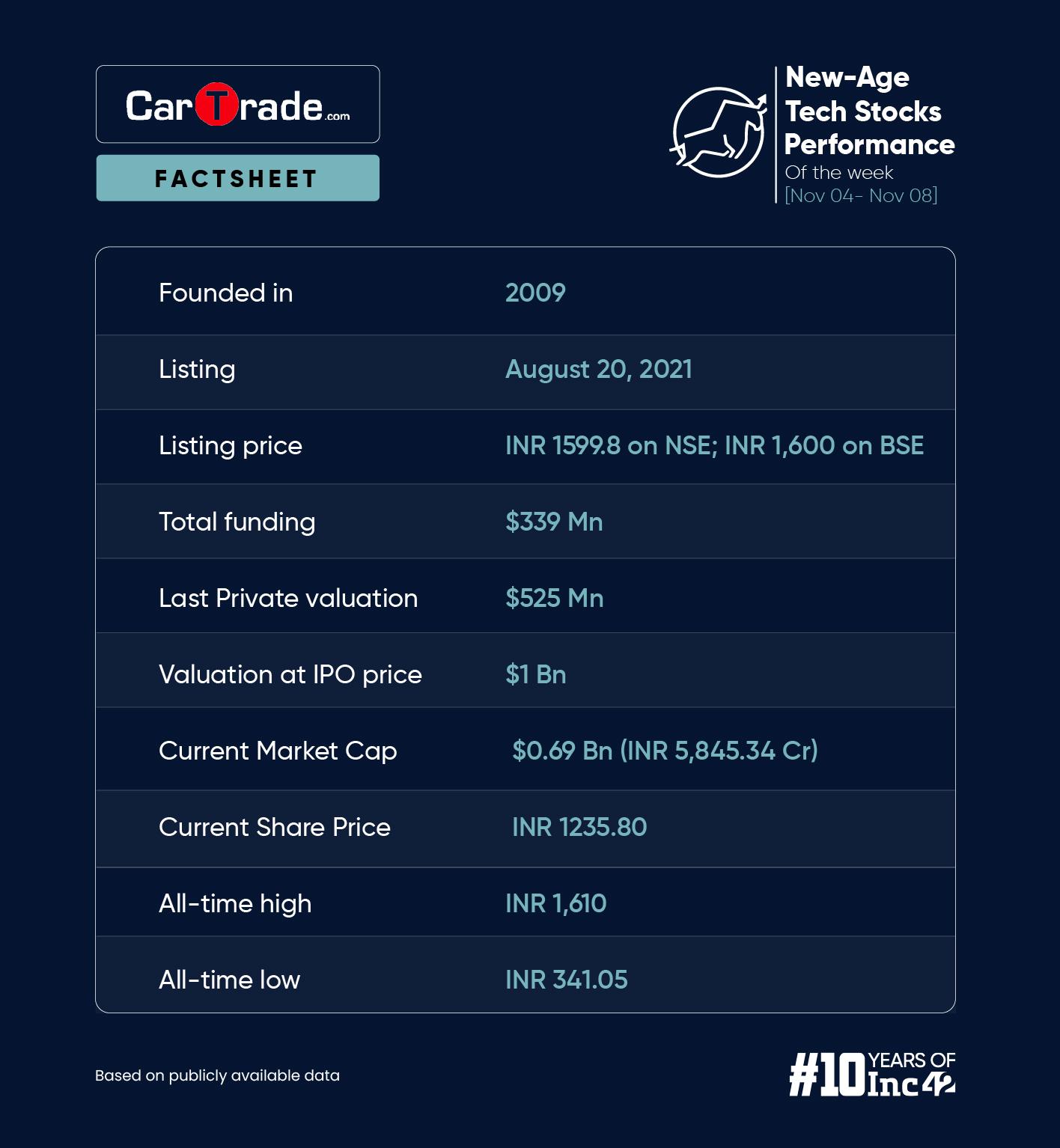

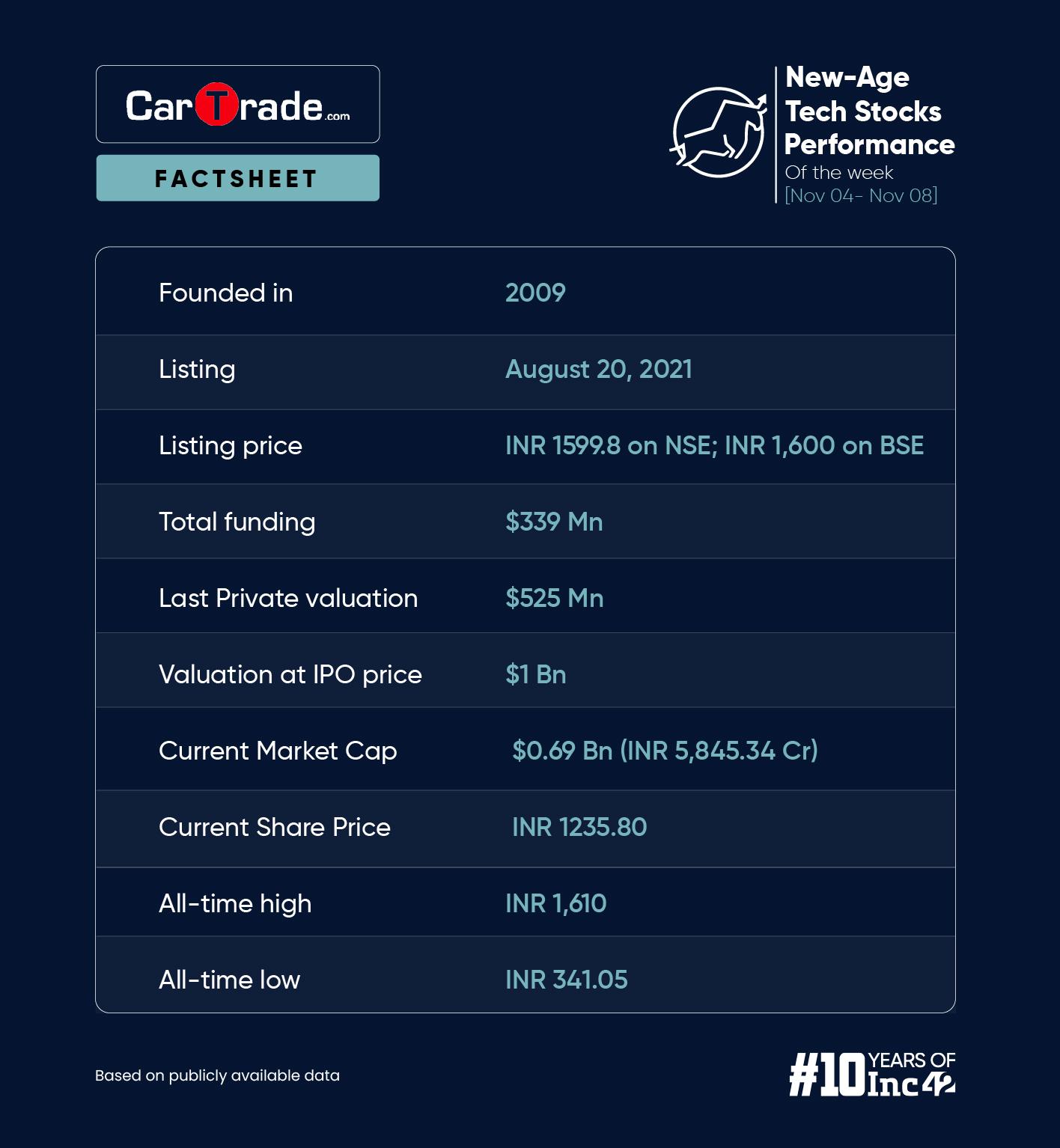

CarTrade Continues Its Bull Run

Investors turned bullish on shares of online classifieds and auto auction platform CarTrade after its Q2 results. Its shares ended the week 13.38% higher at INR 1,235.80.

The company reported a net profit of INR 30.72 Cr in Q2 FY25, up over 6X from INR 5.04 Cr in the year-ago period. Revenue from operations rose 28.4% to INR 154.20 Cr in Q2 FY25 from INR 120 Cr in Q2 FY24.

The company’s founder Vinay Sanghi said that the quarter saw the company’s revenue touch an all-time high.

On November 5, the company claimed that it is expecting to report a 30% year-on-year (YoY) increase in revenue in the third quarter for its consumer group, which comprises CarWale and BikeWale. Besides, the company said that the monthly unique customers for the aforementioned platforms surged 36% YoY in October 2024 during the festive period.

“This festive season has been excellent for CarWale and BikeWale. Our platforms have seen unprecedented consumer interest, resulting in record revenues and traffic growth,” CarTrade’s consumer group CEO Banwari Lal Sharma said.

It is pertinent to note that the shares of the company touched a 52-week high of INR 1,278.20 on November 8. The share prices of the company have zoomed over 18% after it released its Q2 numbers.

Ola Electric Continues To Be Under Pressure

Troubles for Ola Electric continued to escalate this week as its share prices plunged to a fresh all-time low of INR 72.53. The stock ended the week at INR 72.74, down 12.04% from last week.

With this, the company’s shares have now fallen 4.28% below its listing price of INR 75.99. Its market cap also declined to $3.8 Bn.

The company has been under fire due to complaints about poor after-sales service.

The week saw Ola Electric announcing its ‘BOSS of All Savings’ marketing campaign as part of its ongoing Biggest Ola Season Sale (BOSS) campaign.

As part of the ‘BOSS of All Savings’ proposition, the company said in an exchange filing on November 7 that users can now save up to INR 15,000 on the purchase of an Ola S1 and further up to INR 30,000 annually.

However, vehicle body Automotive Research Association of India (ARAI) has been concerned about this particular sale in the past, sending the company an email over the BOSS campaign back in October. According to reports, the association was wary of the pricing practices that the company is using for this particular campaign. Further, ARAI is also concerned that this could affect the model’s eligibility for a government subsidy.

In its response, Ola Electric said that it has not changed the price of its escooter Ola S1 X 2KWh and is running a very limited time festive campaign for a brief period where it is giving a general discount of INR 5,000 to every customer and higher discount of INR 25,000.

Ola Electric released its Q2 financials this week, with its net loss declining 5.5% to INR 495 Cr from INR 524 Cr in the year-ago quarter. However, the loss rose 43% on a sequential basis.

Operating revenue jumped 39% to INR 1,214 Cr during the quarter from INR 873 Cr posted in Q2 FY24.

The company said it delivered 98,619 escooters in Q2 FY25, which helped it maintain market leadership with 33% share.

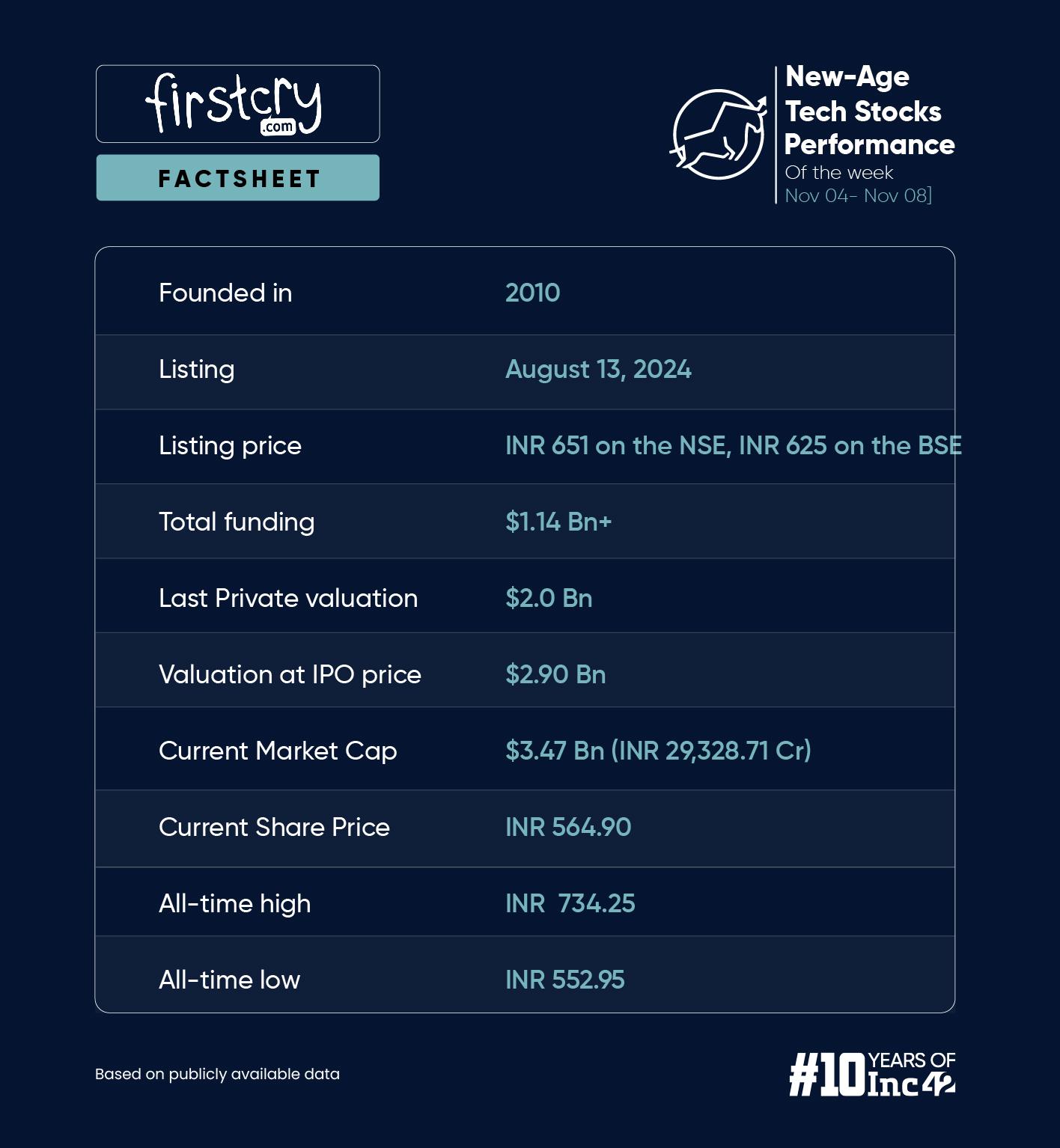

Tax Troubles For FirstCry Turn Investors Wary

Shares of omnichannel kids brand FirstCry plunged 11.91% to end the week at INR 564.90. The downward movement began on November 7 after the company informed the exchanges that it is currently under the radar of tax authorities.

In its exchange filings, the company said that the Assistant Commissioner of State Tax, Mumbai has initiated inspection into its affairs beginning November 6 at the company’s head office in Pune and at one of its warehouses located at Bhamboli in Maharashtra.

“The company is cooperating with the officials and is responding to all the clarifications and details sought by them. This has not impacted the operations of the company, which are continuing as usual,” it said.

The filings revealed that the inspections were being undertaken under sub-section (2) of Section 67 of MGST Act 2017. Investigations under this section are invoked when authorities have reasons to believe that an entity has suppressed any transaction relating to supply of goods or services, or both, or the stock of goods in hand, or has claimed input tax credit in excess of entitlement.

Despite the clarifications, the company’s shares tanked to an all-time low of INR 552.95 on Friday. With this, its shares prices have fallen 9.62% below its listing price of INR 625.

The company is set to release its Q2 FY25 results on November 14.