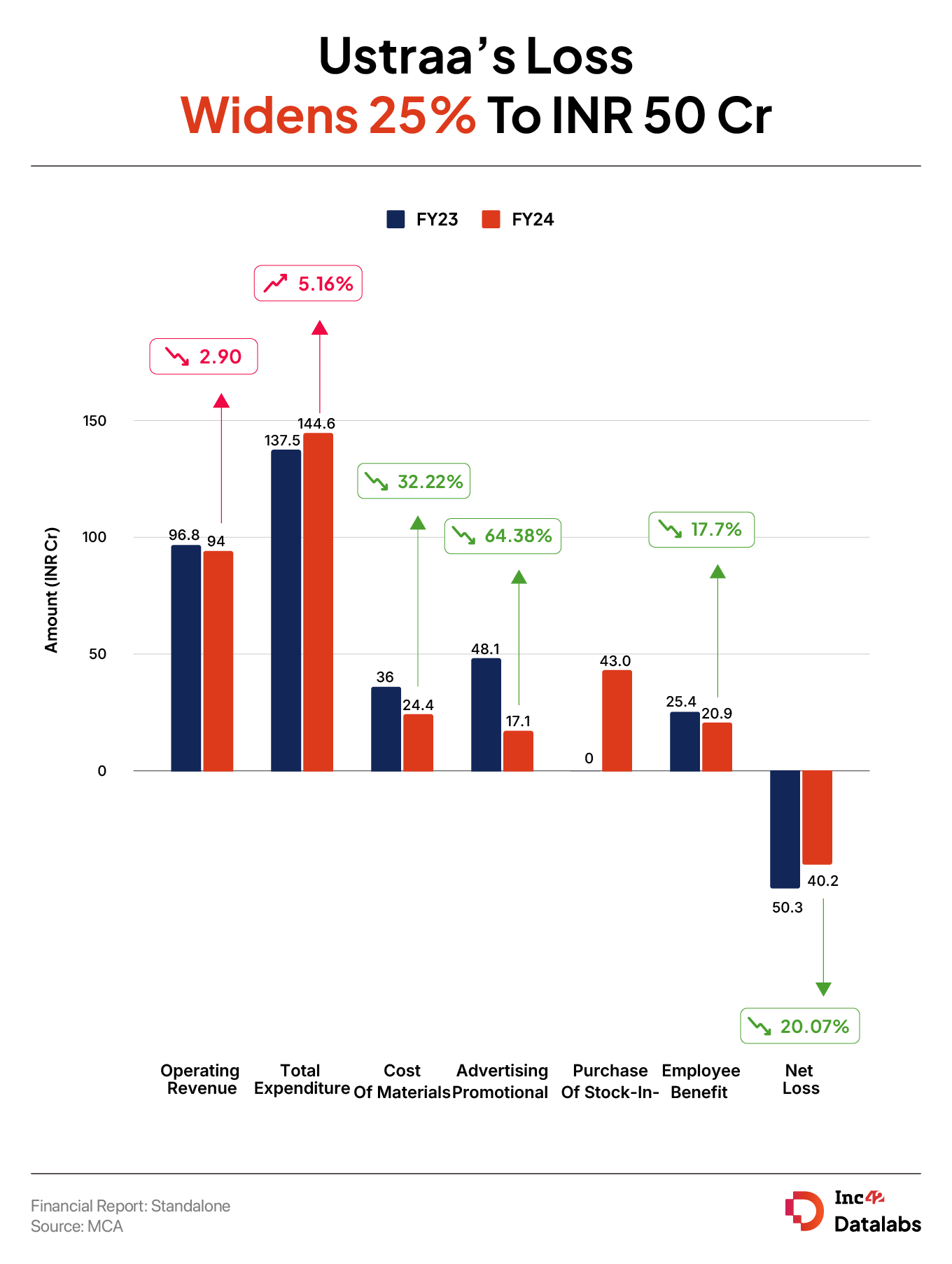

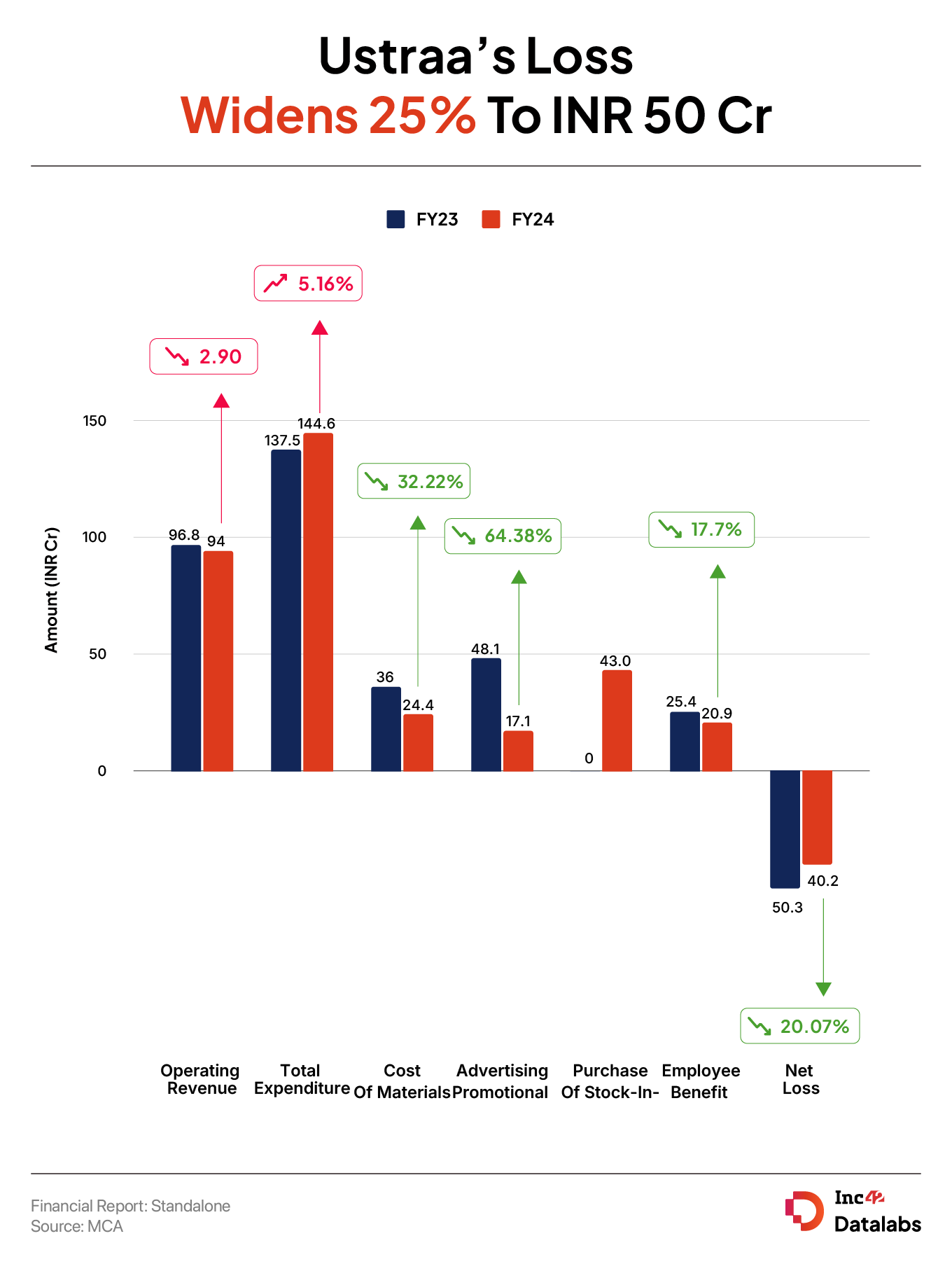

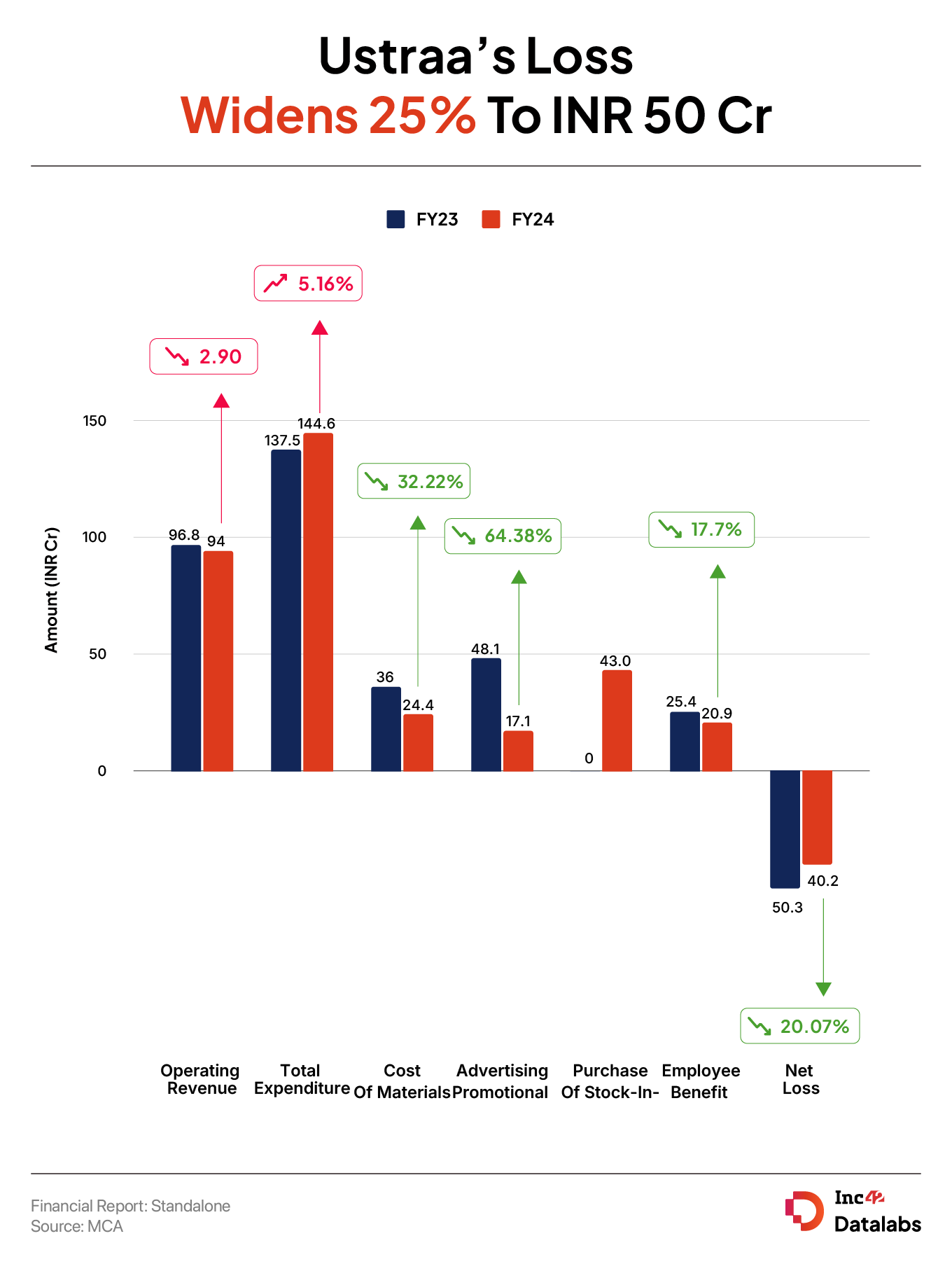

Men’s grooming D2C brand Ustraa, which is owned by wellness brand VLCC, saw its net loss jump 25% to INR 50.3 Cr in the financial year 2023-24 (FY24) from INR 40.2 Cr in the previous fiscal year.

Its revenue from operations also declined 2.9% to INR 94 Cr during the year under review from INR 96.8 Cr in FY23.

Founded initially as ‘Happily Unmarried’ by Rahul Anand and Rajat Tuli in 2003, Ustraa rebranded to its current avatar in 2015 when it forayed into the D2C space.

Beauty and skincare brand VLCC announced acquisition of Ustraa in June 2023 in a deal pegged at INR 61 Cr in a mix of cash and share swap. The transaction was said to have been undertaken at a 40% discount to the D2C startup’s previous valuation.

Almost a year before the acquisition, Ustraa raised INR 16.8 Cr in a strategic funding round led by Info Edge’s subsidiary Startup Investments in October 2022. In total, the startup raised $10 Mn since its inception.

Zooming Into The Expenses

Despite the decline in revenue, Ustraa’s total expenses rose 5.1% to INR 144.6 Cr in FY24 from INR 137.6 Cr in FY23.

Cost Of Materials Consumed: Expenditure under this head declined 32.2% to INR 24.4 Cr during the year from INR 36 Cr in FY23.

Purchase Of Stock-In-Trade: Ustraa spent INR 43 Cr under this head in FY24 as against nil in the previous year.

Employee Benefit Expenses: Employee costs fell 17.7% to INR 20.9 Cr in FY24 from INR 25.4 Cr in FY23.

Employee benefit expenses include salaries, gratuity, PF, among others. The decline indicates that Ustraa might have reduced its head count during the year under review.

Advertising & Promotional Expenses: Ustraa managed to reduce its advertising and promotional expenses by 64.4% to INR 17.1 Cr in FY24 from INR 48.1 Cr in previous fiscal year.

Transportation Cost: The spending under the head shot up 8.8% to INR 10.1 Cr from INR 9.3 Cr in FY23.

Miscellaneous Expenses: Ustraa spent INR 14.8 Cr under the head as against INR 1.8 Cr in FY23. However, it didn’t give a breakdown of miscellaneous costs.