One of India’s most celebrated beauty brands Mamaearth

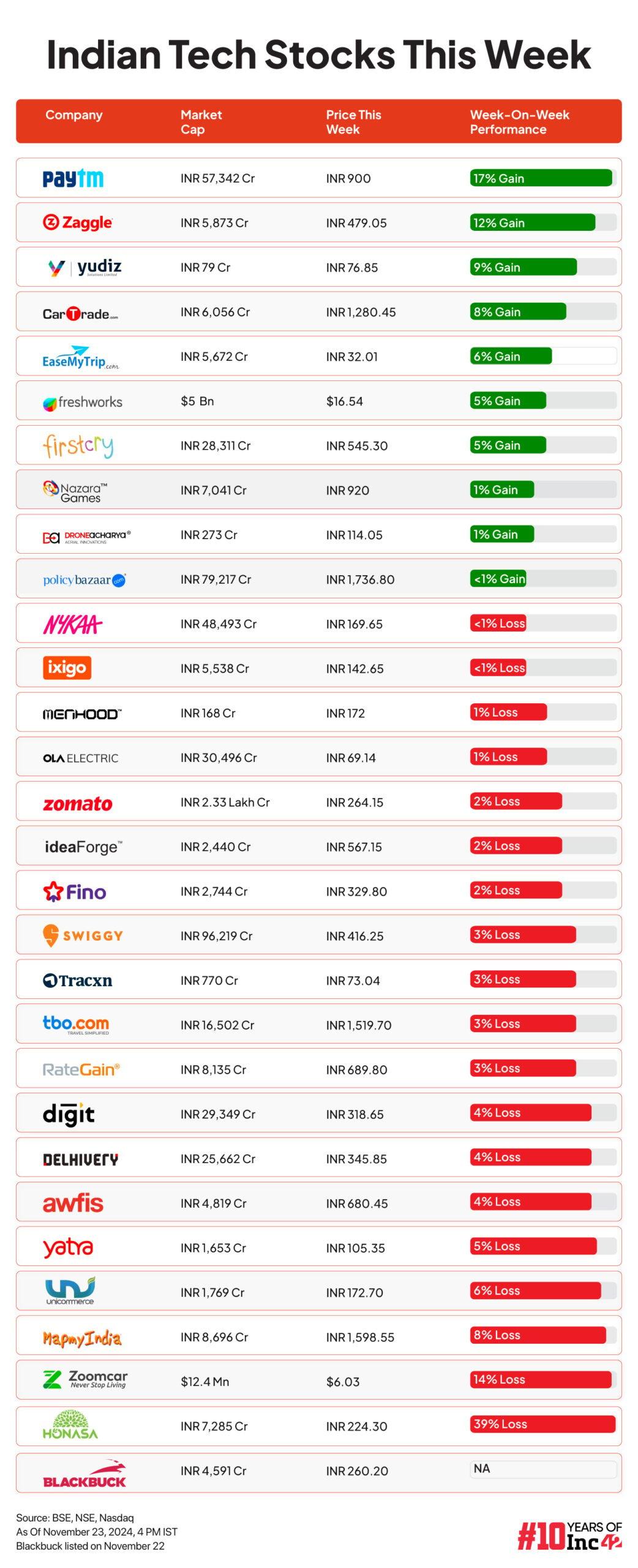

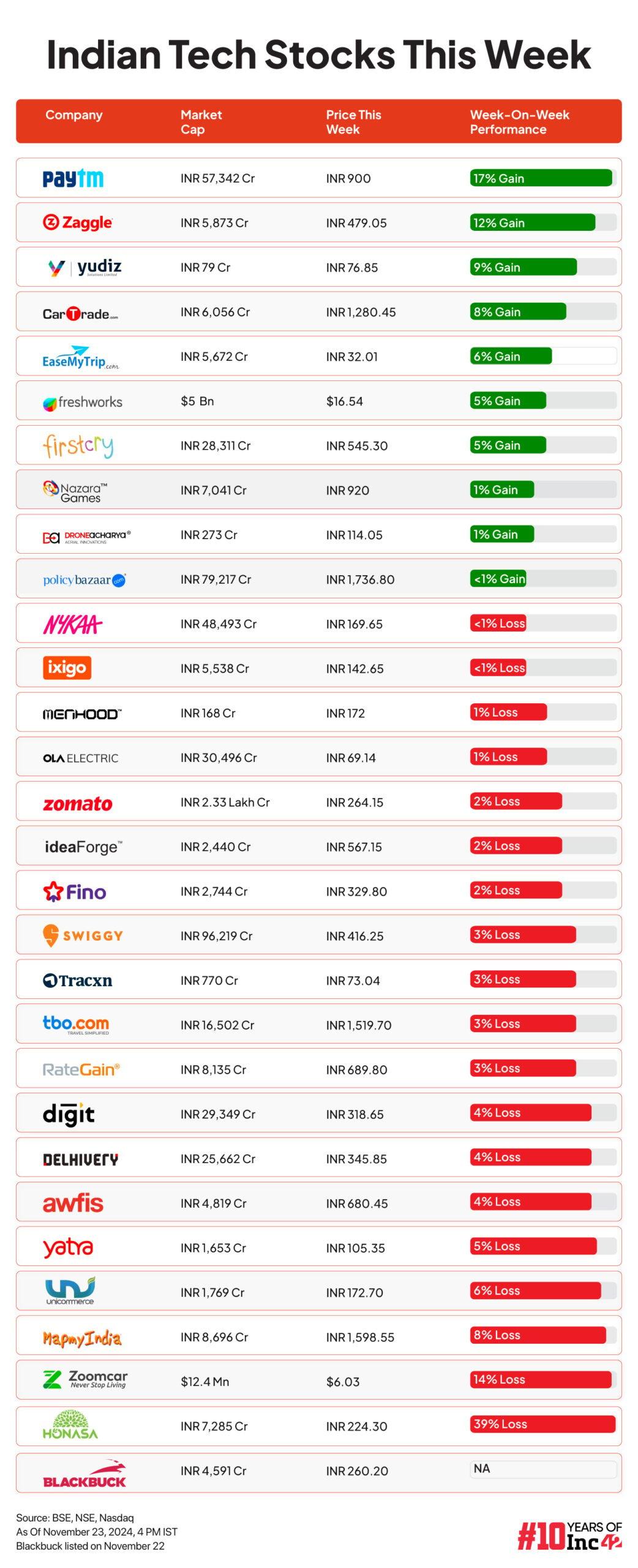

The company posted dismal Q2 FY25 results; its stock plunged for the whole of last week, losing a whopping 40% of value. Investors are very likely to be spooked by the direction of the financials and the stock, and more value erosion can be expected in the next few days.

Honasa has also lost the unicorn tag (although that might well be temporary) and more importantly the trust of distributors and customers to a certain extent. Which way will the brand and the company go?

That’s what we will look to answer this Sunday, but first a look at the key stories from our newsroom:

- Amazon’s Festive Cheer: The demand for premium product categories in India and faster deliveries has unlocked a new insight for Amazon India, which claimed that it still has an edge over quick commerce players

- Pratilipi’s Content Bet: Over the past three years, Pratilipi has built a repository of 15 Mn stories and even refined its monetisation model, but profitability has remained elusive. What will it take for this to change?

- Behind The GenAI Buzz: With infrastructure and horizontal solutions being dominated by global AI giants, Indian VCs and investors say FOMO is driving a lot of investments in Indian GenAI startups

What Went Wrong For Honasa?

One of the only D2C startups in India to reach an annual revenue mark of INR 2,000 Cr mark, which it posted in FY24, Mamaearth seemed to have found the profitability formula by the end of March this year.

However, the company quickly turned cash flow negative with the first six months of FY25 (April to September) seeing a 7% revenue decline YoY. Honasa also slipped into losses, pretty much swinging from high to low in just six months.

Brokerages are now recommending a “Sell” rating for the Mamaearth stock, instead of the erstwhile optimism.

Although a slowdown in consumption has moderately impacted the stock prices of retail heavyweights and Mamaearth’s rivals in the beauty and personal care space such as Unilever, ITC, among others, Honasa’s problems are not limited to this industry-wide slowdown.

Cofounder and CEO Varun Alagh said in a recent analyst call that the company did not anticipate the high impact on margins from the renewed offline distribution strategy under ‘Project Neev’, introduced in November 2023.

The company went from super stockists in its supply chains to direct distributors. This eliminated a big cost and allowed the company to walk towards profits, but this change which is being adopted across all Honasa markets has had an adverse impact on the company’s financials.

Uncertainty Hits Mamaearth

The CEO also acknowledged that Mamaearth’s brand equity and growth also suffered due to the changes.

“I think the second area where again our assumptions have not panned out in line has been the growth for Mamaearth. I think the model that we are trying to execute was very similar to what has worked for the brand in the past. We have recognised that there are a few strong tweaks that we need to make across the mix from a product mix perspective, in terms of SKU sizing,” he said.

He also said the company needs to become sharper on communication around which brands are seeing the budget allocation. “Our learning is that we have gone too wide and we need to narrow our focus onto a few categories and go deep within them with our hero SKU,” the Honasa CEO told analysts.

Jefferies said in a note that the inventory correction and loss therein was disappointing, and the CEO’s comment on reworking the playbook creates further uncertainty.

Mamaearth is the flagship brand of Honasa, accounting for a majority of its revenues in FY24. Further, more than 65% of the company’s revenues comes from online channels.

Fast forward to Q2 FY25 and Honasa’s investor presentation now states, “Mamaearth is growing slower than our expectations and we are making identified structural changes to bring it back to its growth trajectory in a few quarters.”

Is Honasa’s Marketing Paying Off?

The company’s investor presentation also says that changing consumer buying patterns from family oriented purchases to individual-led approach thanks to new channels has had an impact on revenue. One such channel is quick commerce, which has changed the retail distribution dynamics in metros and Tier 1 cities.

Plus, Honasa said that the emergence of new categories through influencers is leading to more evolution of trends and experiments, which brands cannot afford to ignore.

Industry experts underlined that the slow demand, the inability to earn customer loyalty and thereby repeat orders are factors that should alarm Honasa. One important metric is the customer acquisition cost (CAC), which has steadily gone up for Honasa.

Advertising spends stood at INR 183 Cr for Q2 FY25, nearly 40% of the INR 462 Cr revenue. The marketing spends overall in H1FY25 have also gone up to INR 383 Cr from INR 336 Cr in H1 FY24.

A founder of a skincare brand and Mamaearth rival said that Honasa’s aggressive marketing spends have outshined every competitor and without such spending, the revenue would be even lower. “This is very high compared to the industry norm of allocating 20% of the total revenue to brand building and marketing,” the founder, who did not wish to be named, said.

This also means that Mamaearth and other Honasa brands do not attract repeat customers. “The higher CAC means that repeat orders are slowing down. Repeat customers have a lower CAC, and this is likely one of the reasons why the flagship brand Mamaearth is experiencing growth challenges,” a digital marketing analyst told us.

Distributors Saddled With Stock

For offline retail distribution, Honasa’s Project Neev has been the reason for ire for distributors. Distributors have alleged that the company dumped inventory worth hundreds of crores, which was returned by retailers.

Stock worth more than INR 300 Cr is said to be lying unsold across various warehouses, even though Mamaearth has rubbished these claims.

“We have been cautioning Mamaearth about this inventory pile up since the IPO. This year we have seen a very high rate of return compared to the last few years, due to damaged goods, expired products. They have been lying with us for months now. We work on a credit system with the retailers where if the stock is purchased by consumers, only then will we be paid,” All India Consumer Products Distributors Federation (AICPDF) national president Dhairyashil Patil told Inc42.

He added that retailers have reported slow demand for Honasa products and they have returned inventory en masse. Honasa also owes INR 50 Cr to distributors in the ACPDF, Patil claimed. “We have now been approached by a Senior VP at Honasa that they will address our concerns,” Patil added.

Another Bengaluru-based retailer and wholesale distributor said that Honasa has not kept up with customer preferences that have drastically shifted in the past year, with higher demand for Korean products and make-up brands promoted or owned by celebrities.

“We tend to keep the BPC products on our shelves for 2-3 months. This is a reasonable time to gauge consumer interest. We were seeing higher demand for Mamaearth for baby and shampoo, sunscreen products earlier, but now we see customers, especially young people, asking for Korean skincare replicas, active ingredients-based products etc.,” the retailer added.

He added that many customers are also insisting on importing skincare products from the UAE, South Korea or Turkey where these products are competitively priced and have a global following.

Falling Behind The Times

Honasa’s innovation team is headed by cofounder Ghazal Alagh, and this is where the product development takes place — ranging from formulation, clinical trials, stability and batch level testing, quality assurance, packaging, pricing and positioning. Apart from Mamaearth, Honasa which calls itself “house of brands” also has The Derma Co, Aqualogica, Dr. Sheth’s, Bblunt, Ayuga, STAZE under its belt.

Honasa has acknowledged this new wave of demand for active ingredients-based products, where Mamaearth’s product portfolio is perhaps not very strong. However, in 2023, the company launched an unusually high number of 122 products with multiple size SKUs in the market which analysts say could have also led to brand dilution .

“Skincare works on trust factor. And this takes time and experience in the market. Launching more than 100 products in one year is definitely very problematic, and indicates that Mamaearth was trying to simply keep up with rising competition rather than win consumer trust,” another D2C beauty brand founder told Inc42.

In the investor call, Alagh said, “We realised that we were allocating our investments over 10 different categories in Mamaearth and that was too wide a dispersion of investment which was happening. Our hero SKUs and categories were getting suboptimal investments because of that and that’s a clear recognition that we have had.”

The rapid increase of quick commerce in India over the past couple of years has also provided increased visibility to new and early stage D2C brands. Honasa said the “rise of quick commerce is not only changing distribution but also potentially impacting buying behaviour of pantry and shopping”.

The company which had cracked the marketplace formula in the past with Mamaearth will have to now adjust rapidly to the quick commerce wave with a bevy of brands, or else risk fading into irrelevancy in the key metro and urban markets.

“As beauty brands see rapid adoption on quick commerce platforms, the fight for shelf space in dark stores is getting more intense, and for larger D2C brands getting new SKUs into these dark stores is not easy. Marketing costs for brands on quick commerce are increasing, and this will even out as the market matures,” the D2C brand CEO quoted above said.

While Honasa scripted history by becoming the first D2C house of brands to list publicly, the game has changed rapidly in the last 24 months. Now the company behind Mamaearth has to write a new playbook, or perhaps even two, for both online and offline channels and win back the trust of not only consumers but also distributors.

Can Honasa pull this off and get back to profitability?

Sunday Roundup: Tech Stocks, Startup Funding & More

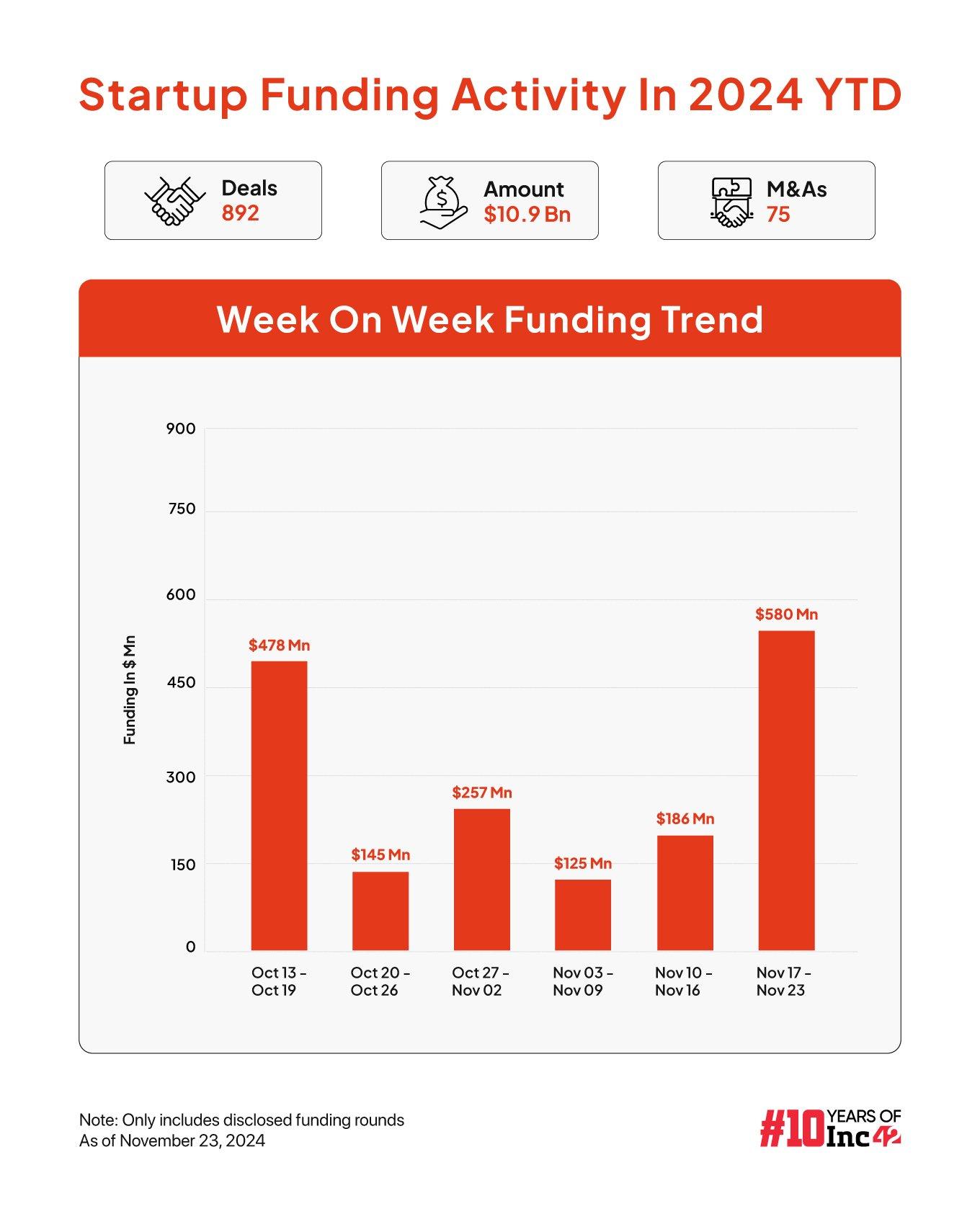

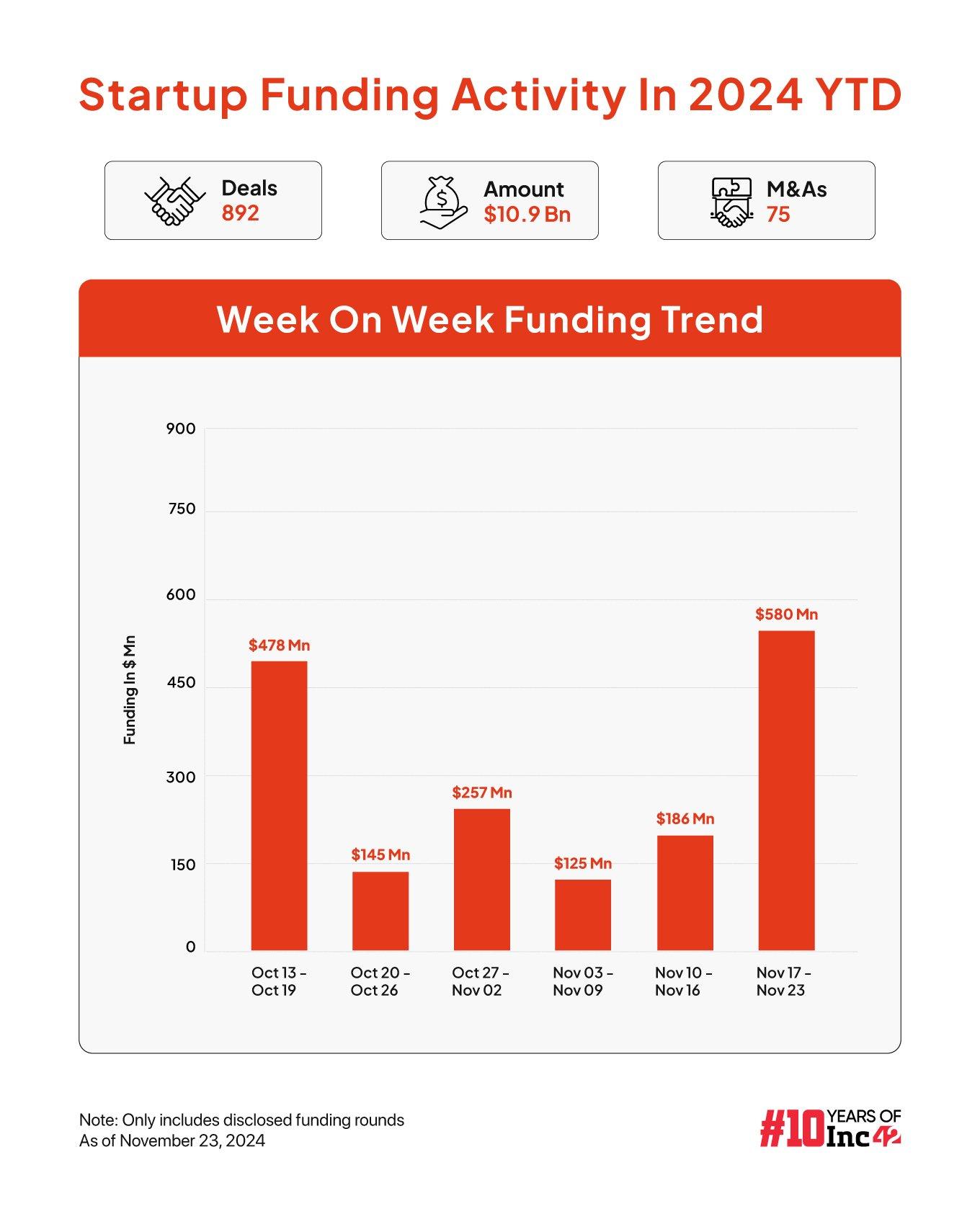

- Funding Spikes: Indian startups cumulatively raised $579.5 Mn this past week, with the bulk of this coming from Zepto’s $350 Mn round, the startup’s third major fundraise this year

- BlackBuck’s Muted Debut: BlackBuck shares fell nearly 6.5% below the IPO price during the intraday trading on the BSE in its debut session closing at INR 260.20

- Ola Consumer’s IPO Bid: Taking the first step towards its IPO, Bhavish Aggarwal-led Ola Consumer (formerly Ola Cabs) has turned into a public limited company

- Zomato Joins Sensex: BSE will add foodtech major Zomato to its flagship BSE Sensex, replacing JSW Steel, from December 23, marking a major milestone in the Indian startup ecosystem history

- OfBusiness Preps For Listing: SoftBank-backed B2B marketplace OfBusiness has reportedly roped in five banks for its $1 Bn IPO