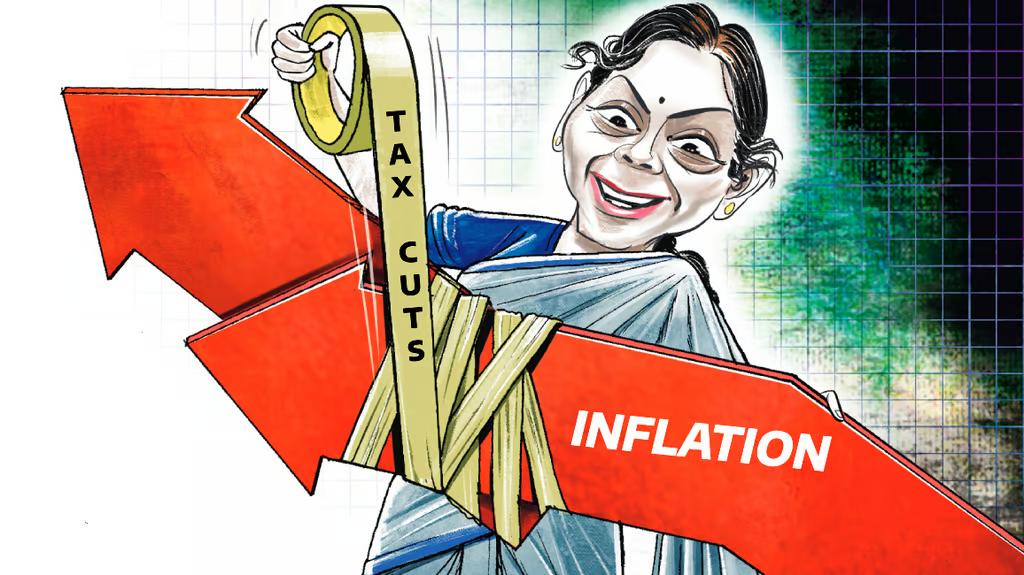

The Union government is reportedly considering a reduction in income tax for individuals earning up to Rs 15 lakhs, according to a media report.

Reuters, citing two government sources, reported on Thursday that the tax cuts could be implemented in the 2025-26 Union Budget. The sources, speaking on condition of anonymity, said the size of the cuts remains undecided, with a final decision expected closer to the February 1 budget.

If implemented, the tax break will provide relief to India’s middle class and boost consumption amid the economic slowdown and rising living costs.

Notably, India’s income tax system features two regimes (Old Tax Regime and New Tax Regime), offering taxpayers the choice between deductions and lower tax rates.

The Old Tax Regime (OTR) is a legacy system which allows for deductions and exemptions, such as investments in insurance, provident funds, and housing loans.

Under OTR, the tax slabs for individuals below 60 years are as follows: income up to Rs 2.5 lakh is not taxed, income between Rs 2.5-5 lakh is taxed at 5 percent, income between Rs 5-10 lakh is taxed at 20 percent, and income above Rs 10 lakh is taxed at 30 percent.

The New Tax Regime (NTR) was introduced in 2020 and offers lower tax rates. However, it does not allow exemptions or deductions.

Under this regime, income up to ₹3 lakh is not taxed, income between ₹3-7 lakh is taxed at 5 percent, income between RS 7-10 lakh is taxed at 10 percent, income between Rs 10-12 lakh is taxed at 15 percent, income between Rs 12-15 lakh is taxed at 20 percent, and income above ₹15 lakh is taxed at 30 percent.

Notably, India gets a bulk of its income tax from those making at least ₹10 lakh, the rate for which is 30% under OTR. Thus, any tax cuts or basic exemptions may also make the NTR an attractive option.

A reduced tax burden could benefit salaried individuals and boost disposable income which could drive higher consumer spending, aiding economic recovery during the slowdown.

This comes at a time when the government continues to face criticism from the middle class over higher taxation, as inflation pushes up the cost of living, while wage growth struggles to keep pace with demand.

The voices advocating for growth over fiscal and monetary prudence are growing louder, particularly after the second-quarter GDP figures highlighted the economic fatigue that has set in.

Recently, Chief Economic Advisor V Anantha Nageswaran had criticised the disparity between record profitability and stagnant worker salaries, calling for a balance between profitability and workers’ income to stimulate consumption.

Noting that corporate profitability was at a 15-year high in FY24, Nageswaran had said that much of this income was being diverted by companies to reduce their leverage.

“While it is good to improve balance sheets, corporate profitability and workers’ income growth has to be balanced,” he had said, adding that, “without this parity, there will not be adequate demand in the economy for corporate products to be purchased.”

The general perception is that the government has tightened the screws a bit too much on the middle class and needs to give some succour to help revive consumption, which has been lagging for far too long.