Understanding and interpreting chart patterns is crucial in the world of technical trading. Among these patterns, the bull pennant stands out as a reliable indicator of potential market breakouts. This article explores how traders use bull pennants to predict upward movements, guiding their trading strategies for profitable returns.

What Is a Bull Pennant?

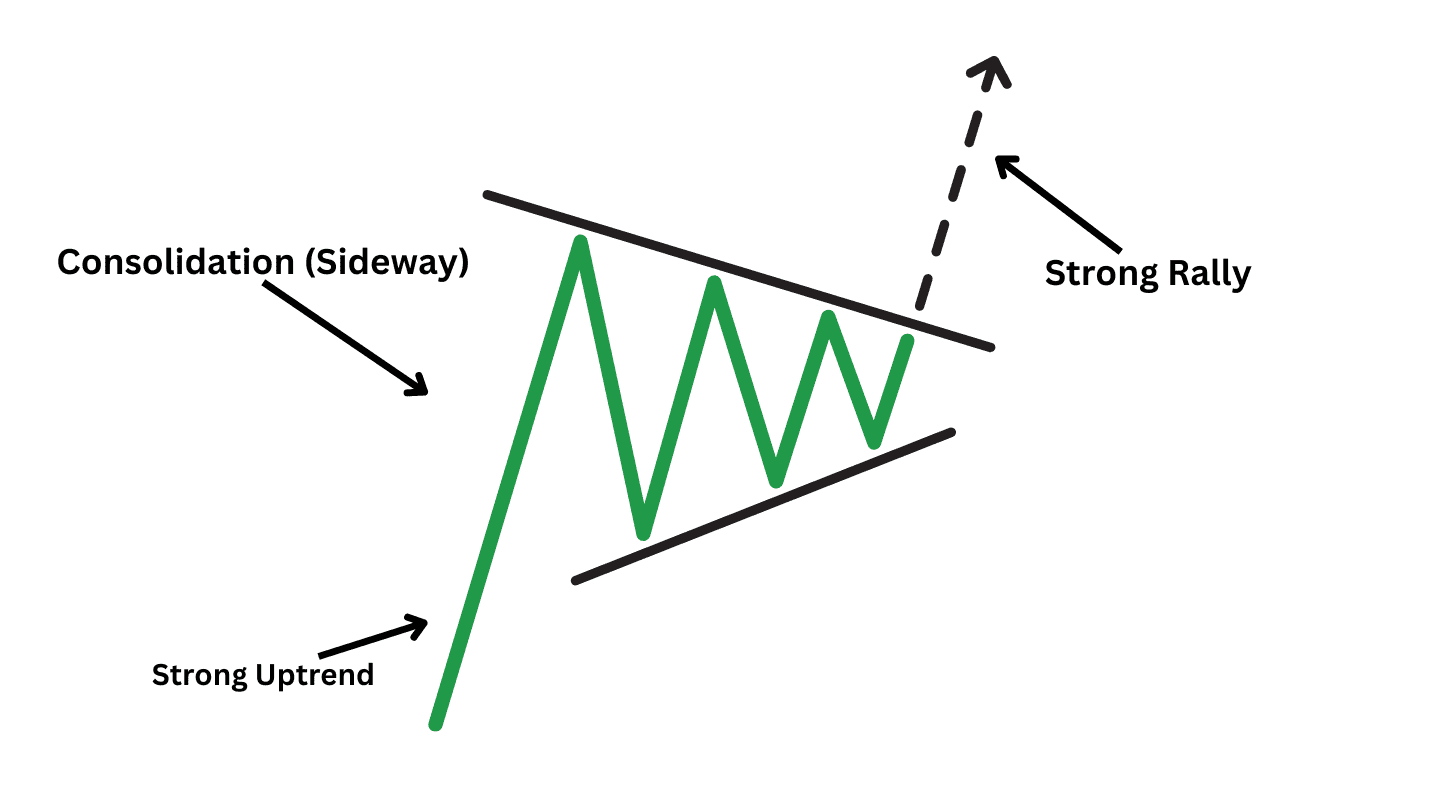

A bull pennant is a continuation pattern that forms during an uptrend. It consists of a sharp price rise, followed by a period of consolidation where prices trade within converging trendlines. The consolidation resembles a small symmetrical triangle, often indicating that the market is catching its breath before the next upward move.

The two key components of the bull pennant pattern are:

- Flagpole: The initial surge in price leading to the pennant formation.

- Pennant: The triangular consolidation pattern that develops before a breakout.

Once the breakout occurs, it typically continues in the same direction as the previous trend, offering traders a high-probability opportunity to enter or add to their positions.

Key Characteristics of Bull Pennants

Bull pennants stand out for their short duration, usually lasting from a few days to a couple of weeks. This makes them attractive for swing traders and day traders looking for rapid gains.

- Volume Spike: A notable volume increase often accompanies the flagpole, reflecting high buying interest.

- Decreasing Volume: During the pennant consolidation, volume typically decreases.

- Breakout with Volume: A successful breakout will usually occur with another surge in trading volume.

The ability to spot these patterns and act quickly is crucial for traders aiming to capitalize on market momentum.

How to Identify Bull Pennants on a Chart

Traders rely on technical analysis tools to identify bull pennants. Look for a steep price rally followed by a brief consolidation where prices narrow into a triangular shape. Pay attention to trendlines, which guide the expected breakout.

Example:

If a stock surges by 10% within a short span and then enters a tight consolidation zone, you may have found a bull pennant. Use a trendline to connect the highs and lows during the consolidation to confirm the pattern.

Trading Strategies for Bull Pennants

Once traders spot a bull pennant, timing is essential. Here are common trading strategies for maximizing profits from bull pennants:

1. Entering at the Breakout

- Buy orders are placed just above the resistance trendline of the pennant.

- A stop-loss is often set below the pennant’s low to limit losses if the trade moves against expectations.

2. Measuring the Target Price

- The target price is usually calculated by adding the length of the flagpole to the breakout point.

- This gives traders an idea of the expected upward movement.

Importance of Volume in Bull Pennant Patterns

Volume plays a significant role in validating a bull pennant breakout. A breakout without increased volume might indicate a false breakout, where the price reverses soon after crossing the resistance line. Traders at Alchemy Markets and other platforms closely monitor volume spikes during breakouts to confirm the pattern’s strength, ensuring that the price movement aligns with expectations. Relying on strong volume data helps traders avoid false signals and make more informed trading decisions.

Bull Pennants in Different Markets

Bull pennants appear across various financial markets, including:

- Forex: Traders use bull pennants to predict currency pair movements during bullish trends.

- Stocks: In equity markets, bull pennants often indicate a continuation of rallies following earnings announcements or market news.

- Cryptocurrency: Crypto traders monitor bull pennants to capitalize on volatile price surges common in digital asset markets.

Why Bull Pennants Are Ideal for Short-Term Traders

Bull pennants are ideal for traders seeking quick profits. The pattern is compact and usually resolves in a short period, allowing traders to ride the trend without holding positions for too long. However, traders must stay vigilant and exit the trade if the breakout fails, as false breakouts are a common risk in volatile markets.

Conclusion

Bull pennants are a powerful chart pattern for traders looking to capitalize on market momentum. When identified correctly, they signal the continuation of an uptrend, providing traders with opportunities to enter trades at optimal points. By using volume as a confirmation tool, setting appropriate stop-losses, and calculating target prices accurately, traders can increase their chances of success.

Bull pennants appear across various financial markets, from forex to cryptocurrency, making them a versatile tool for trading strategies. Incorporating bull pennants into your trading routine could offer the edge you need to achieve consistent profits

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)