Flipkart, which held a 13.2% stake, or 2.1 Cr shares, in BlackBuck via its Singapore-based subsidiary Quickroutes International ahead of the IPO, is offloading 55.3 Lakh shares for around INR 151.1 Cr

Accel is selling 43.1 Lakh shares for about INR 117.6 Cr, resulting in 4.3X gains

Peak XV Partners and VEF AB are selling portion of their shares in BlackBuck at losses

As logistics unicorn BlackBuck

BlackBuck set a price band of INR 259 to INR 273 per share for its initial public offering (IPO).

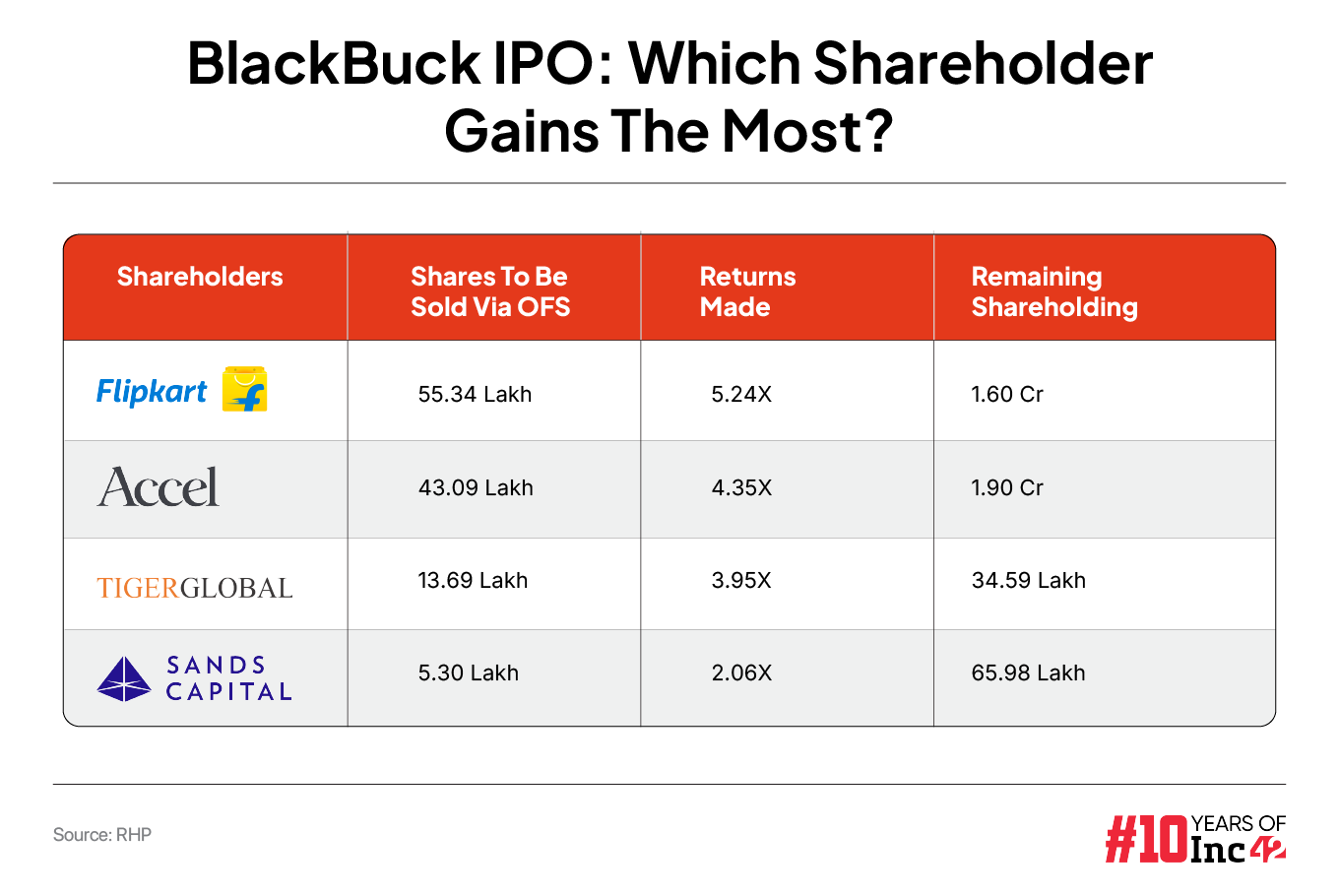

Flipkart, which held a 13.2% stake, or 2.1 Cr shares, in BlackBuck via its Singapore-based subsidiary Quickroutes International ahead of the IPO, is offloading 55.3 Lakh shares for around INR 151.1 Cr at the upper end of the price band as part of offer for sale (OFS) in the IPO. The company acquired these shares for about INR 28.8 Cr, translating to 5.24X returns on the investment.

On the other hand, Accel India IV (Mauritius) Limited held a 14.31% stake in BlackBuck, or 2.3 Cr equity shares, that it acquired at an average cost of INR 62.71 per share. Accel is selling 43.1 Lakh shares for about INR 117.6 Cr, resulting in 4.3X gains on its investment in the company.

Accel and Flipkart Logistics Private Limited first invested in the trucking platform in 2015 in its $6 Mn Series A funding round. In early 2016, BlackBuck raised its $25 Mn Series B round from Tiger Global, Apoletto Asia. This round also saw participation from Accel and Flipkart.

In 2018, Flipkart transferred its ownership in Flipkart Logistics Private Limited to its Singapore-based subsidiary Quickroutes International Private Limited. Over the years, Quickroutes and Accel continued to increase their stakes with further follow-on investments in BlackBuck.

Founded in 2015 by IIT Kharagpur alumni Rajesh Yabaji, Chanakya Hridaya, and Rama Subramaniam, BlackBuck initially started as a truck aggregator. It currently offers a full stack of solutions – from load management and telematics to payments for fuel, FASTag or toll charges, and truck financing. It operates a B2B marketplace specialising in inter-city full truckload (FTL) transportation.

The logistics unicorn’s IPO comprised a fresh issue of shares worth INR 550 Cr and an OFS component of more than 2.06 Cr shares.

Among the other selling shareholders, Tiger Global’s Internet Fund III will get 3.95X returns by selling 13.69 Lakh shares of the company. The global VC giant acquired these shares for approximately INR 9.4 Cr, and is now selling them at INR 37.4 Cr at the upper end of the price band.

On the other hand, Sands Capital and International Finance Corporation, who first invested in BlackBuck in its Series C funding round, are also set to make big gains. While Sands Capital will make 2.1X gains by offloading 5.3 Lakh shares, World Bank-backed International Finance Corporation will make 1.4X returns by selling almost 23.4 Lakh shares as part of the OFS.

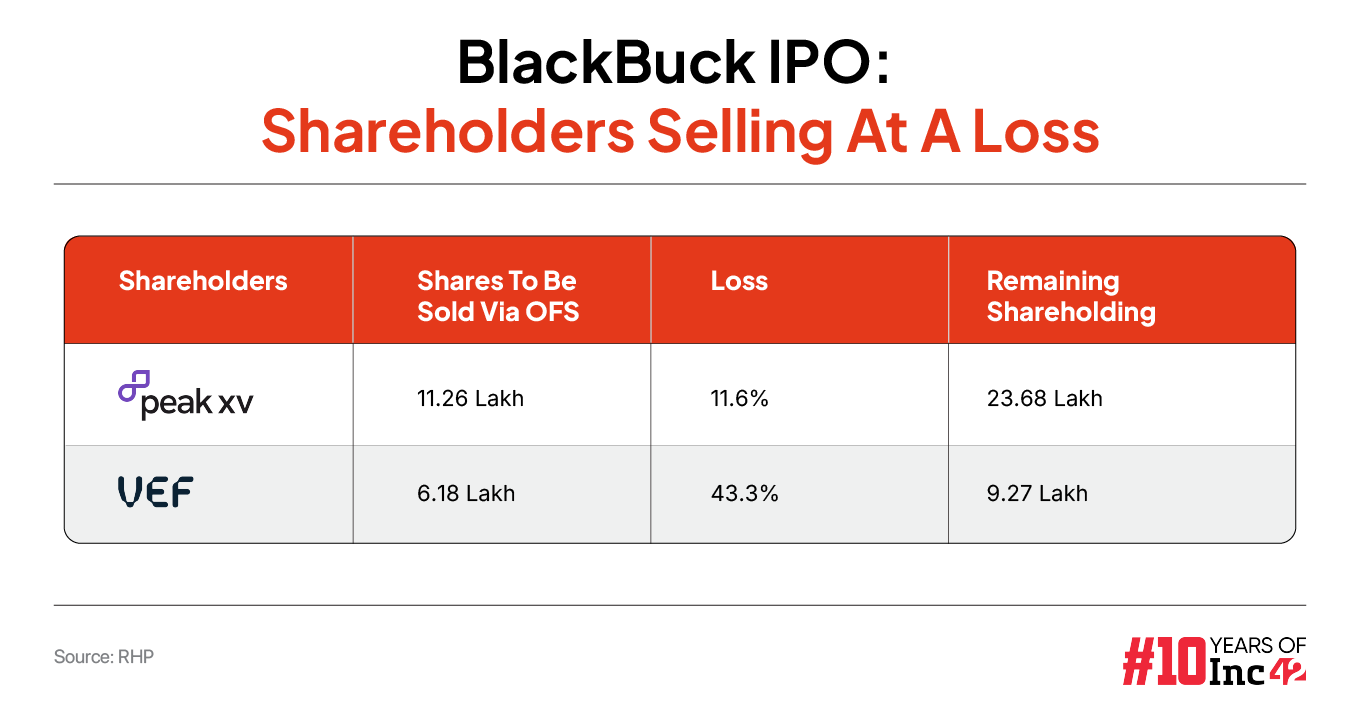

However, Peak XV Partners (formerly Sequoia Capital), which also first infused capital in BlackBuck as part of its extended Series C funding round, is set to make an 11.6% loss on its investment in the startup.

Ahead of the IPO, Peak XV held a 2.14% stake, or 34.94 Lakh shares, in BlackBuck that it had acquired at an average cost of INR 308.98 per share. As part of the OFS component, the leading VC firm will offload 11.26 Lakh shares, making INR 30.7 Cr as against INR 34.8 Cr it spent to acquire these shares.

Similarly, Swedish investment firm VEF AB is selling almost half of its shares in BlackBuck, making more than a 43% loss on its investment in the company.

It is pertinent to note that the aforementioned shareholders are selling only partial stakes in BlackBuck and will continue to hold stakes in the company after the IPO.

Meanwhile, promoter and CEO Yabaji, who held the highest stake (14.45%) in the company pre-IPO, is expected to pocket at least INR 60.6 Cr by selling 22.2 Lakh shares as part of the OFS. Yabaji had acquired these shares at merely INR 8,000.

BlackBuck’s two other promoters, cofounders Hridaya and Subramaniam, are selling 11.9 shares each during the IPO, and will make INR 30.3 Cr each.

A Recap Of BlackBuck’s IPO

The company filed its DRHP in June this year for its IPO comprising a fresh issue of shares worth INR 550 Cr and an OFS of up to 2.16 Cr shares. However, BlackBuck reduced the OFS component slightly while filing its RHP earlier this month.

BlackBuck is also going public at a lower valuation. As against its 2021 valuation of INR 7,400 Cr, the company is eyeing a valuation of a little over INR 4,800 Cr in its IPO.

Despite lowering the valuation to capture more investors, the startup’s public offering was oversubscribed by only 1.86X, lower than all the other mainboard new-age tech startup IPOs this year.

While the QIB quota was oversubscribed 2.76X, the IPO received 1.65X subscription from retail investors. The NIIs placed bids for merely 24% of the shares reserved for them.

Ahead of the IPO, BlackBuck raised INR 501.33 Cr from anchor investors, who subscribed to 1.83 Cr equity shares at INR 273 apiece.

The listing of the company’s shares on the NSE and the BSE is expected this week.

It must be noted that shares of foodtech major Swiggy listed at an 8% premium to its issue price last week. Its IPO also received a muted market response compared to other new-age tech startups that went public this year.