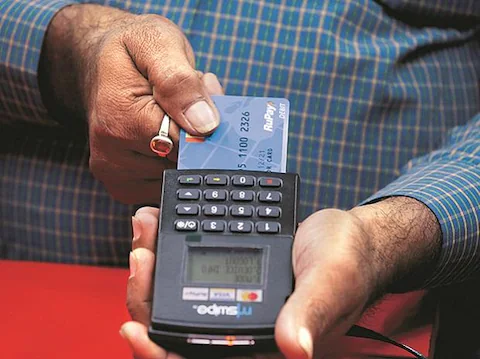

The National Payments Corporation of India (NPCI), the parent company of UPI, has set an October 31 deadline for banks to activate offline transactions on their RuPay cards. The move will provide a boost to the One Nation, One Card ideology shortly after the RBI issues the offline payments framework in January 2022.

According to a Business Standard report, RuPay cards must comply with the framework by the end of the month, and non-compliant cards must be re-issued and receive NPCI’s qSPARC specifications. The Reserve Bank of India has maintained that digital payments consume significant system capacity and bank resources, despite the fact that more than half of UPI transactions have a value of less than INR 200. To help the ecosystem, the RBI implemented a wallet-style feature for low-value transactions.