CRED’s drive (pun intended) for new products has far from abated. With a new vehicle management platform joining Kunal Shah’s stable of products this year, there was already a lot of spotlight on CRED in recent days.

And to top this, the release of its unaudited FY23 financials made CRED pretty much the talk of social media this week. The numbers make for optimistic reading for the Bengaluru-based fintech giant.

And as we have seen this year, CRED and Shah are going for a major product push to add more momentum to the revenue pace.

After many years of wondering what CRED’s vision and model would look like when it figures out the product-market fit, perhaps we are seeing the emergence of a different kind of CRED as it embraces the fintech super app model.

Follow along to see how the company has shifted with the evolution of the fintech market and seemingly found itself on the right track, but after these top stories of the week from our newsroom:

Dunzo’s Disaster: How did the Reliance Retail-backed hyperlocal delivery giant blow through more than $360 Mn of funding in the past four years. We try to answer this burning question.

Hotstar’s Last Dance? With the ICC cricket World Cup kicking off this past week, it’s almost like a last throw of the dice for Disney+Hotstar in the OTT battle. Will the bet on free streaming pay off?

A Season Of Financials: It’s not just CRED; Groww, True Elements, MobiKwik, Paytm Money and Skyroot also disclosed their FY23 numbers, which you can find all in one place in our financial tracker

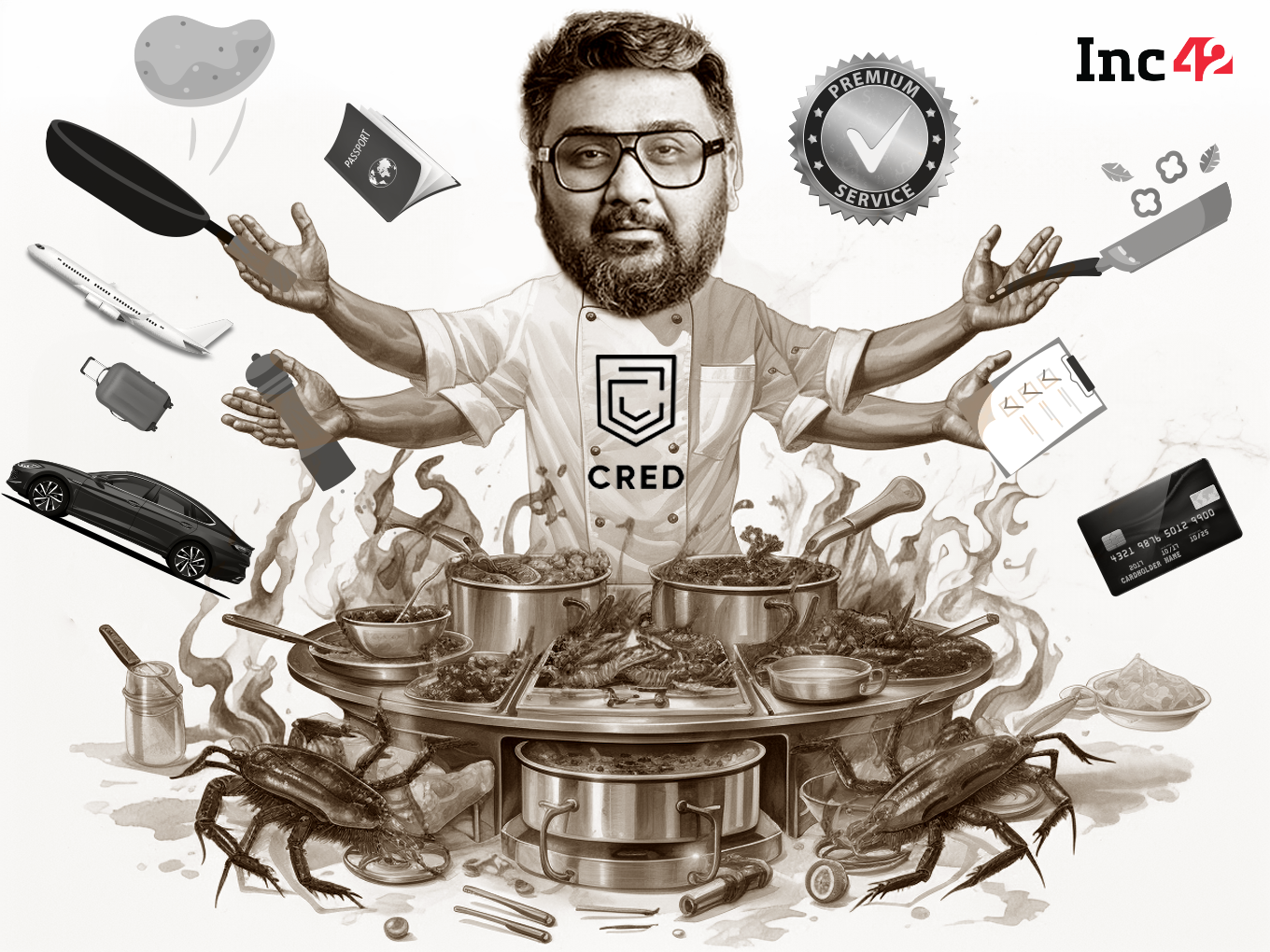

CRED’s Kitchen

From travel to ecommerce to vehicle management and its core fintech products — the CRED universe is expanding rapidly. In fact, the recent launch of ‘CRED garage’ took most of the ecosystem by surprise and many are left asking why.

Revenue is of course one part of it, but there’s a clear demographic shift happening in the core audience of credit card users. More and more new credit cards are being issued and these users are not the premium users that CRED typically caters to.

TAM Grows

The total number of credit cards issued is close to touching the 100 Mn mark, as of August 2023. This number was 57 Mn in August 2020, so the CRED’s primary audience of credit card users or premium users in other words is becoming a little less premium.

As is the case with any instance of any inflection point, the growth is fuelled by the long tail of ‘low value’ credit card holders. This is the base that CRED wants to reach because ultimately the vision is to target users that are already monetisable.

In CRED’s early days, when credit card usage in India was quite possibly restricted to maybe 55 Mn to 60 Mn users, the company added ecommerce and luxury travel bookings to its platform. The ecommerce play largely focussed on niche products from premium to mid-tier D2C brands.

Travel and ecommerce are ways to capture a big slice of the credit card spending that its primary target users are most habituated to. This was a way for the company to retain a chunk of the credit card spending.

Reports this week indicate that CRED is instead going for a high-volume play on the ecommerce side and is moving away from its thus far exclusive focus on premium D2C products.

Make no mistake, CRED is still a premium app, but perhaps it’s becoming a little more loose with velvet ropes.

Payments Push Pays Off

CRED has pushed hard on marketing itself as an all-in-one spot for payments and credit cards to become the first port of call for many of these new users. UPI is by no means a premium monetisation play, but CRED is going for this in a big way too.

CRED is fourth on the most used UPI apps, behind PhonePe, Google Pay and Paytm. As per the NPCI data, UPI logged more than 1,000 Cr transactions in August 2023, out of which CRED processed 8.5 Cr transactions, but this is 2X higher than the 4.2 Cr transactions it saw in April 2023.

Besides this, the fintech unicorn is looking at expanding and casting a wider net for its lending products. It will target even those users who do not have a credit card or may not even have a credit history, essentially those who are outside its current target of premium fintech users.

Indeed, when one looks at the revenue-focussed plays from CRED in the past year, it looks like the company finally has achieved a critical mass of users to justify the premiumness of its offerings, while also perhaps gentrifying itself a little bit for the new fintech user coming into the fold.

Revenue Needle Moves

This finally brings us to the big piece of news around CRED this week, which was the company’s FY23 financial performance. The startup reported a total revenue of INR 1,484 Cr in FY23, a 251.6% increase from INR 422 Cr in the previous fiscal year.

On the other hand, losses grew marginally at 5% to INR 1,347 Cr, thanks to expenses growing to INR 2,831.9 Cr from INR 1,702 Cr.

The startup claimed that one-third of the credit card bill payments by value were done on its platform during the year under review and the total payment value rose to INR 4.4 Lakh Cr from INR 2.5 Lakh Cr in the previous fiscal year.

On a unit economics level, CRED spent INR 2 to earn every single rupee from operations. But that’s a major improvement from INR 4.3 it spent last year to earn a rupee of operating income. So, there have been some measurable improvements for CRED in the past 12-16 months, and new products are very clearly a part of it.

Where CRED Garage Fits

Last week, the startup launched CRED garage where users can add vehicles and get access to perks such as concierge service, reminders, document management, vehicle insurance claims, FASTag support and insights on spending on fuel and other vehicle needs.

While it’s likely that CRED might offer some kind of discounts to its users, many of these features have an attached commission. Selling, renewing or helping settle auto insurance claims and FASTag payments are the prime examples of such commission-based revenue streams.

Of course, all that was left was the marketing, and we know CRED knows how to build hype more than any other startup in India. The launch of ‘garage’ was quintessentially CRED — lots of mystery and a snazzy reveal.

It will definitely bring a lot of users to CRED. The company might have found it hard to take users away from UPI market leaders, so it’s going after areas that these rivals are not focussing on, as per fintech analysts.

A typical UPI user might not have used CRED for payments or travel booking or anything else that Paytm or PhonePe also offer, but the vehicle management product is not matched thus far by those rivals.

For years many have wondered about CRED’s long-term plans, and the picture is seemingly becoming clearer now.

Of course, the challenge will be to get ‘garage’ users more frequently transacting on CRED in other verticals. That seems like a product-driven challenge and few companies in India have the polish in tech, design vision and talent to pull it off.

Startup Spotlight: How Indifi Honed Its MSME Lending Chops

MSME lending in India remains the big hope for a host of digital lending startups. As fintech startups have flocked to the lending aisle with simple bank partnerships to grab a piece of the revenue potential, the likes of Indifi are creating MSME-specific risk models to edge out new and traditional competition.

Led by Alok Mittal and Siddharth Mahanot, Indifi reported a net profit of INR 5.1 Cr in FY23, its maiden profit after five years of operations. This makes it a rare startup in the fintech space.

Mittal believes Indifi’s competitive edge over traditional lenders lies in how it integrates category-specific data and eliminates biases in lending to niche entrepreneurs. This is how Indifi created this MSME lending stack.

Sunday Roundup: Tech Stocks, Startup Funding & More

Q4 Begins Flat: The final quarter of the year began on a weak note with just $119 Mn raised by startups and just 11 deals recorded

Festive Sales Forecast: What does the 2023 festive season hold for ecommerce players and will there be fireworks or muted celebrations? Here’s the outlook

Slice’s Banking Play: Fintech unicorn slice announced a merger with North East Small Finance Bank after receiving the RBI nod to seek the requisite approvals to close the deal

Zomato Rally: Zomato continued its resurgence on the stock market and touched a 52-week high before finishing the week 2% higher than the last one

Founders At The Exit Door: Polygon, Dunzo and Zolostays all saw cofounders step away from their positions to move on to new opportunities as the trend of entrepreneurs quitting their startups continues

That’s all for this week. We’ll be back next Sunday with another roundup

The post title=”Is CRED Finally Cooking?” href=”https://inc42.com/features/is-cred-finally-cooking/”>Is CRED Finally Cooking? appeared first on Inc42 Media.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)