India’s beauty and personal care (BPC) brands are looking good and growing fast, riding a wave of consumer trust, investor enthusiasm and product innovation. Per a Redseer-Peak XV estimate, the Indian market will see the highest CAGR of 10% from 2022-2027, outpacing China and the US with much bigger per-capita spending on BPC products. In fact, India may account for nearly 5% of a $660 Bn global market by then, soaring to $30 Bn from $19 Bn in 2022.

Despite the waves of change, the funding scenario is not dismal, either. BPC startups raised more than $1 Bn between 2014 and H1 2024, with hundreds of brands eyeing the market.

As new ventures grew, especially after a D2C (direct-to-consumer) deluge since the pandemic, can BPC brands set new trends and thrive in a crowded market? Or will they glow briefly and quietly fade away, shuttering businesses or falling prey to consolidation?

However, one-year-old Hyphen, a personal care venture and a sister brand to mCaffeine, is apparently in a class of its own. For PEP Technologies, the parent of mCaffeine, launching a second venture in the same space almost after a decade was more of a strategic move to create differentiated value rather than drive business momentum.

It is evident that MCaffeine

Unsurprisingly, the founding team had to cope with two major tasks to stay relevant in a space where cult products often debut on social platforms, via influencer marketing, and obsolescence sets in if fresh formulations and new ingredients are missing for long. Clearly, a new brand was needed to preserve the USP of the mCaffeine product line and bring in a different range of ingredients and products so that users ‘have it all’.

“After building mCaffeine for years, we knew that the brand has a specific appeal and use cases. Stretching it too far [in terms of product add-ons not corroborating with its key theme and ingredients] could kill it. So, we decided to launch another brand,” said Tarun Sharma, cofounder and CEO of mCaffeine and Hyphen.

lockquote>

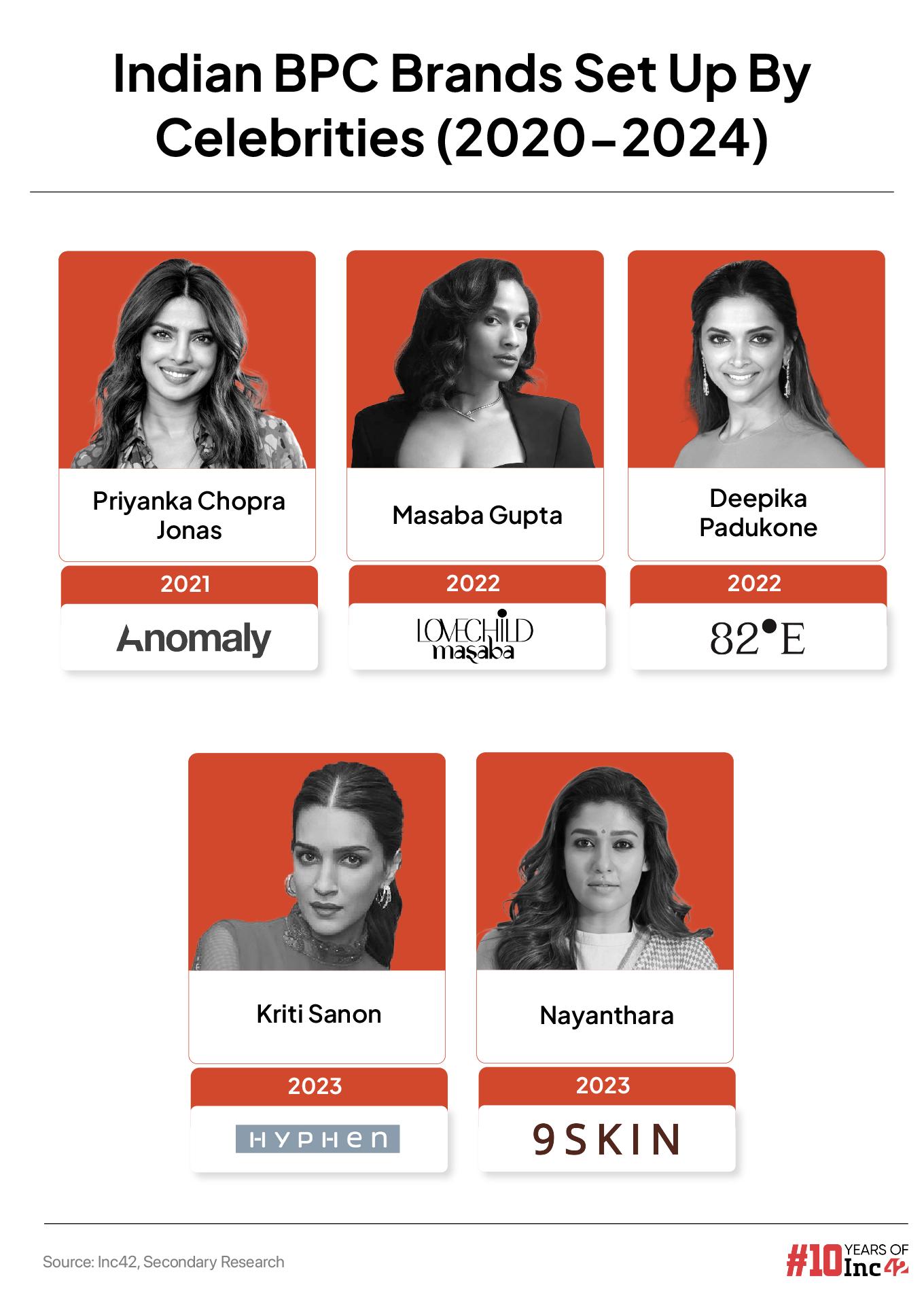

Actor Kriti Sanon also joined the leadership team as a cofounder and works diligently as the chief customer officer, looking after product reviews and responding to user queries.

Hyphen offers 21 SKUs for comprehensive facial care, including cleansers, moisturisers, serums, sunscreens, lip balms and anti-pigmentation products. It claims that its offerings are 100% vegan (does not contain any animal extracts or by-products), cruelty-free (not tested on animals). On the other hand, mCaffeine mostly produces a body care line, including body scrubs and body washes, among others.

For now, Hyphen products are only available online across major marketplaces, quick commerce platforms and its own D2C website. It claims annualised gross sales of INR 100 Cr by July 2024, a user base of 1 Mn and reaching 20K pin codes by leveraging mCaffeine’s distribution network. The brand has also received an infusion of INR 30 Cr from its parent company, PEP Technologies, which holds a majority stake in the business.

Hyphen’s USP: A Natural-Actives Balance For Safety & Effectiveness

The concept of Hyphen started taking shape in 2021 when Tarun Sharma and Vaishali Gupta identified a critical gap after extensive conversations with hundreds of mCaffeine users.

Although naturals (ingredients extracted from plants and vegetables) became popular around 2013-2014, users were doubtful about their long-term effectiveness. The alternatives are lab-made ingredients (actives) with proven functionalities, as they undergo extensive trials regulated by the U.S. Food and Drug Administration (FDA) and other similar organisations across countries. However, long-term use of these chemical products was also perceived as harmful as customers leaned towards the therapeutic power of natural products during the Covid-19 pandemic.

“The product line of mCaffeine is based on natural formulations. We stick to ingredients derived from coffee, tea and chocolate and supplement them with glycerides and vitamins. But given the evolving mindset of consumers who wanted the best of both worlds, the challenge was to find a proper balance, blending the benefits of naturals and actives into a single product,” Sharma told Inc42.

The cofounders and their R&D team went all out to fuse nature with science to address complex facial care needs.

After two years of research, endless internal debates and 18 months of trials and errors to perfect the formulations, Hyphen was launched with a sunscreen, a face serum and two moisturisers.

lockquote>

Although mCaffeine and Hyphen have an identical sourcing strategy and rely on top-grade Indian suppliers, the latter has a broader mix of ingredients, a different production process (as its product line and formulations differ from mCaffeine) and a rigorous 32-point quality testing system similar to its sister brand, ensuring that every product meets exacting standards from sourcing to manufacturing.

As Hyphen harmonises potent actives with soothing naturals, it is positioned as a performance-driven and science-backed solution provider that can optimise quality. Its products are priced at a 10% premium over mCaffeine due to the extensive research involved.

Sharma emphasised that Hyphen’s competitive edge lies in successfully implementing its business basics. “In the actives space alone, you will find more than 30 brands. But those who succeed stick to the core principles, execute them well and create differentiation. Many brands failed despite unique propositions because their execution fell short.”

How Hyphen Took A Leaf Out Of mCaffeine’s Playbook To Corner Success

Hyphen has a robust R&D team and a sound range of products containing tea tree extract, avocado oil, peptides, retinoids, ceramides, alpha arbutin, kojic acid and azelaic acid, which serve as powerhouse ingredients for facial care. But reaching the INR 100 Cr milestone could not be a walk in the park.

In the first few months, the brand encountered what most newcomers do – not enough visibility and, hence, the lack of fast growth naturally expected with a sister brand like mCaffeine thriving for years.

“Initially, we were banking on tremendous organic growth, relying on PR and word-of-mouth. Of course, the new brand resonated with some consumers, but we somewhat stagnated within the first six months,” said Sharma.

For context, Hyphen clocked INR 30 Lakh in gross sales in the first month (July 2023) and doubled in the third month to INR 60 Lakh. But by then, the promoters were worried about a few anomalies in consumer discovery and desires.

lockquote>

Interestingly, the repeat purchase rate in those early days was nearly 100%, underscoring the brand’s effectiveness. But the business badly needed new footfalls to grow its customer base. The team also found that the initial buzz stemmed largely from Sanon’s strong social media presence.

Given these insights, Sharma and his team realised that the brand’s value proposition, products and pricing worked well, but they needed to focus on the missing pieces – promotion and business operations. It was decided to position Hyphen as a celebrity-led brand as an mCaffeine-like branding would not align with the new entity’s brand’s ambition and target audience. The goal was to see it emerge as a top-selling skincare line and hit the INR 100 Cr milestone at the earliest.

By January 2024, the team ramped up their efforts and adopted the strategic blueprint originally developed for mCaffeine. According to Sharma, Hyphen’s rapid success – from INR 30 Lakh to INR 14 Cr in FY24 and then to INR 100 Cr annualised gross sales in July 2024 – would not have been possible had they not replicated three critical strategies from mCaffeine’s playbook. Here is a quick look at the fundamentals:

Nurturing consumer centricity: Like mCaffeine, Hyphen has a consumer-centric approach from the beginning, and the leaders quickly realised how repeat customers were driving its growth in the initial months.

Today, 60% of Hyphen’s sales come from repeat customers and the average product rating exceeds 4.5 out of five. It has also captured double-digit market share in sub-categories like lip balm.

“What makes this new brand relevant to the consumer? Why would they choose your product over millions? It’s because staying consumer-centric is fundamental, it’s non-negotiable,” said Sharma.

“We keep the 3Cs in mind. We listen to our consumers, build the right categories, and expand channels for easy access. We learnt it when building mCaffeine from scratch and distilled our learning into these core principles. They have taught us how to deliver top-notch products backed by flawless execution.”

Targeting time-bound opportunities: Another key takeaway from mCaffeine is seizing time-sensitive opportunities with calculated energy and precision. Hyphen’s strategic approach to distribution – knowing when and where to launch – is a case in point.

Elaborating its selective approach, the CEO said the brand could not be spread too thin across all distribution channels. Plus, the team had to time it right about starting Meta ads, Google ads and WhatsApp campaigns. Again, the brand won’t enter offline retail until Hyphen hits the INR 400 Cr mark, as traditional retail is expensive.

“We are very data-focussed. We analyse the numbers every time before choosing the best channel/s,” said Sharma. For example, quick commerce was not a good fit for Hyphen in the early days. But as the landscape shifted, the brand was launched on quick commerce platforms this year.

lockquote>

Mastering the 6Ps: The leadership’s journey at mCaffeine brought home the art of mastering the 6Ps: Proposition, product, packaging, pricing, platform and promotion. “If you can nail these, the 7th P – profit – will follow,” said Sharma.

Several factors keep Hyphen aligned with the 6Ps mantra. Its value proposition – the right mix of naturals and actives for best outcomes – has resolved customer pain points at the product level. Ingredients are directly sourced for consistency in quality. A 16-member R&D team is in charge of developing the formulations in-house. And its QA/QC personnel are stationed at partner manufacturers to maintain rigorous quality standards. Despite outsourced manufacturing, the brand retains tight control over every detail.

Hyphen has in place comprehensive SOPs for all its processes and further benefits from the expertise of advisory formulators, many of whom are former Unilever professionals with 20-25 years of experience.

Additionally, it has minimised packaging costs and funnels 80% of its budget on procurement to ensure competitive pricing without sacrificing quality.

Finally, pricing has been carefully worked out, keeping in mind a cost-sensitive market. Hyphen’s products are positioned as mass-premium and cost 30-50% lower than similar companies like Laneige, The Ordinary, Inde Wild, Rhode.

Hyphen Wants To Be An INR 1K Cr Brand; Can It Script A Big Success Story?

The founding team at Hyphen aims to scale the brand to INR 1K Cr. But this may sound too ambitious at this point. The D2C personal care brand is not yet profitable at an operational level, although it is unit economics positive. Plus, it is burning cash due to its ongoing investments in team, technology and R&D.

Its short-term goals are clear, though. The brand eyes operational profitability by FY26 and wants to clock INR 200 Cr in revenue.

lockquote>

In the current financial year (FY25), it plans to focus solely on the domestic market and aims to become a bestseller brand across popular categories like sunscreen, serum and moisturiser. It will also move into new categories (which resonates with Hyphen’s core values), driving repeat purchase rates and diving deeper into Tier II and III locations. Sharma says these will be crucial steps towards achieving the INR 200 Cr mark.

Can Hyphen achieve its lofty ambitions in a competitive market and within a tight timeframe? It may not be impossible. Take Minimalist, a beauty and skincare brand that reached INR 100 Cr in revenue just eight months after its launch.

[Edited By Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)