Mamaearth, the direct-to-consumer (D2C) beauty platform, is reportedly closing down Momspresso MyMoney, the influencer engagement platform of Momspresso, by the end of this month due to mounting losses, according to sources familiar with the matter. Mamaearth acquired Momspresso, a parenting platform, in 2021 for INR 152.3 crore. Momspresso operates three verticals, including a user-generated content platform, brand marketing, and MyMoney.

Sources revealed that MyMoney has experienced a decline in sales since its acquisition by Mamaearth, leading to the decision to shutter the platform. It is also anticipated that Mamaearth will close down Momspresso’s brand marketing business. As a result of these developments, Momspresso has recently laid off around 80-100 employees in various roles, including tech, content, customer service, marketing, and product.

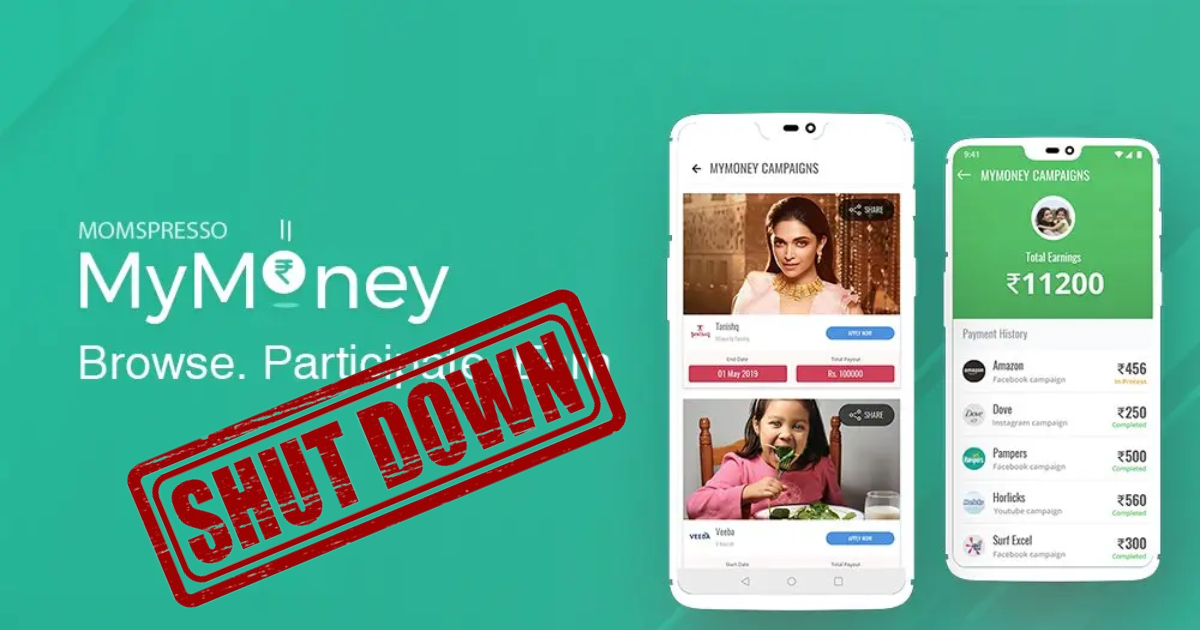

The decision to shut down these loss-making verticals is believed to be driven by Mamaearth’s upcoming initial public offering (IPO). Despite several attempts to seek comments from Mamaearth and Momspresso co-founder Vishal Gupta, no response has been received. Notably, the MyMoney app is no longer available on Google PlayStore, and the iOS app is reportedly experiencing glitches.

Sources further disclosed that Gupta and co-founder Prashant Sinha have launched a new marketing agency and have hired several employees who were laid off from Momspresso. The marketing agency has already begun operations.

Momspresso was Mamaearth’s first acquisition in 2021, aimed at expanding its content and influencer management capabilities. Mamaearth, founded in 2016, primarily focuses on providing parenting tips and pregnancy advice to mothers. Momspresso’s MyMoney platform allowed individuals to work as micro-influencers for brands, while the brand marketing vertical developed content for brands in video and article formats.

Momspresso’s financials show a widening loss in FY22, reaching INR 10.9 crore compared to INR 25 lakh in the previous fiscal year, while revenue increased marginally to INR 31.2 crore from INR 27 crore in FY21. Mamaearth acquired two more businesses, Dr Seth’s and BBlunt, after acquiring a majority stake in Momspresso.

The move by Mamaearth to shut down loss-making verticals aligns with a trend among Indian startups, particularly unicorns, that are streamlining their operations and closing down non-profitable segments to achieve profitability. However, it’s worth noting that Mamaearth reported a net profit in FY22 and the first half of FY23, indicating positive financial performance.